What is a corporation?

A corporation is a legal business entity that removes the legal liability of a stockholder from being personally liable for corporate debts. Each state has individual laws regarding corporations, however, many states follow the Model Business Corporation Act.

A few reasons why someone would want to form a corporation include:

- Additional protection from any legal liabilities

- Easier to attract investors with the ability to issue stock

- Deaths of stockholders/officials don’t change the structure of the corporation

- Stock ownership is easily transferable

If you’re interested in starting a corporation, we can help with fast, reliable formation guaranteed. We’re here to serve corporations as they start, run and grow over time. We can help you create your corporation today. Simply click the “Incorporate Now” button below.

How to Incorporate Online

Ready to get started? Here’s how to get a C corp or non-profit corporation started online:

Step 1: Name your corporation

When naming your business, you will want to choose a name that reflects your brand’s unique identity. You want to think about a few things when coming up with your business name, some of which are legally required, depending on your business location and structure.

In this next section, we’ll review the four things to think about when naming your corporation, specifically:

- Entity name

- Trademark

- “Doing business as” (DBA) name

- Domain name

Choose an entity name

Your business entity name is how you and the state will identify your business. Some states may have rules limiting how you can choose your entity name, including the usage of company suffixes. Most states will not allow you to register a name that’s already registered by another company.

Additionally, some require that the entity name reflects the business you have in some way.

A few notes when coming up with your corporation name:

- Whichever name you settle on must include the word “Corporation,” “Incorporated,” or an abbreviation of one of the two.

- Specific words are off-limits if you don’t offer the service directly. For instance, you cannot include a professional designation, such as “Engineering” or “Attorney,” unless you have licensed members delivering those services.

- There’s typically a site where you can search your name choices to see whether what you have is too similar to current businesses. You will need to eliminate any such names from your list of possibilities.

- The name cannot suggest that it is associated with any government agency or include anything suggesting that it will be engaged in a business that is illegal.

Name your C corp

Enter your desired business name to get started

Checking Trademarks

When it comes to a trademark, you’ll want to look at the state and federal levels. At the state level, you can verify whether your name or logo is trademarked by visiting their online business portal. At the federal level, you should check your prospective business name in the official U.S. Patent and Trademark Office trademark database.

Federal and State Trademarks

Although more costly and time-consuming to obtain, federal trademarks offer far more protection than a state trademark. Since state trademarks only protect your trademark in the registered state, you would lose nationwide protection. A federal trademark is especially beneficial to corporations that expect to do business outside of their home state.

“Doing Business As” (DBA) Name

Registering your business with a DBA name doesn’t provide any legal protection by itself. DBA names are known as trade names, fictitious names, or assumed names. They can be registered with the state, county, or city in which your city is located.

Using a DBA Name for Your Corporation

A DBA name is determined by your location, so multiple businesses in the same state can have the same business name. Although multiple businesses can use the same DBA name, it’s important to ensure that you’re not violating any trademarks since they are held at the federal level.

DBA names enable you to conduct business under a different identity than your own. Additionally, you can open a business bank account with a DBA and obtain a federal tax ID number (EIN).

Domain Name

A domain name is the web address that visitors will use to access your website, and someone like ZenBusiness can help you register your domain name. Perform a quick search to make sure the name is available, and then reserve it before someone else takes it.

Step 2: Appoint directors and a registered agent

Once you’ve decided on a business name, you will need to appoint a board of directors. The board of directors is a group of elected individuals in your company. They essentially establish corporate governance and oversee organizational strategies, investments, profits, and more.

The number of directors varies from state to state, and there are no strict rules for how to structure your company’s board.

Officers or shareholders appoint directors

Officers or shareholders of common stock elect directors. Appointing a director is important because some states require their addresses and the names of directors but also because of their important work. They handle strategies and corporate planning, which can benefit your corporation in the long run.

Most states require at least one director to be appointed; however, the rules vary from state to state. Although directors play an important role in a corporation, they do not have to be owners.

Choose a registered agent

The government requires an official address to send correspondence to an appointed registered agent. A registered agent acts as the middleman between your corporation and the state. Depending on your state, you can appoint yourself or even your business as a registered agent.

Every corporation must appoint a registered agent

Registered agents are necessary to ensure that businesses can be notified in the event of a lawsuit. The physical address must be located in the state and open during business hours so that the corporation registered agent can be reached.

Hiring a Registered Agent Service

Although you can take a do-it-yourself approach when appointing a registered agent, there are many reasons you might want to choose an outside registered agent. For many corporations, it can be difficult to add another set of paperwork.

By choosing a registered agent service, you can have someone else handle the annual paperwork for a relatively small fee. In addition, outsourcing the registered agent role can be a great option for small, web-based corporations that do not have a physical location.

It’s also important to consider that registered agents must be available during normal business hours throughout the year. If the registered agent is not around when they should be, the corporation will run the risk of a lawsuit. To avoid this, a company would need all-day, year-round availability, which is why many corporations choose a registered agent service.

Hiring a registered agent service can help corporations manage paperwork, have a physical address, and operate without any privacy concerns.

Once you have your name, registered agent and board, it’s time to register your C corporation or nonprofit.

Step 3: File the Articles of Incorporation/Certificate of Incorporation

The Certificate of Incorporation, or Articles of Incorporation, is a legal document that must be filed with your state’s business filing agency. It is used to establish your corporation as a C corp or an S corp. Before you file the Articles of Incorporation, you’ll need to choose a corporate name and registered agent.

Some states require you to designate the type of corporation (e.g., C corp, S corp). The document asks for basic business information (company address and the number of shares) and is used to establish your corporation legally.

Each state can have slightly different rules for the Articles of Incorporation. Forms can be found by visiting your state’s business filing agency online.

Most states will require this information:

- Corporation’s name: This is your company’s legal name and typically ends in “Corp” or “Inc.”

- Corporation address: This is the principal operating address. Your corporation’s operating address must be in the state that you filed within.

- Registered agent: You must include your registered agent’s name and operating address.

- Business purpose: This is a statement authorizing the business to engage in any lawful purpose. Some states require a specific description of your business’s services and products.

- Directors and officers: Certain states require that you provide the addresses and names of directors and officers.

- The number of shares: The number of shares needs to be specified. Many businesses decide to leave some shares unissued in the hope of expanding and adding more shareholders in the future.

- Class of shares: Depending on your corporation type, you will need to list your class of stock. C corporations can have multiple (common and preferred) classes of stock. S corp can only have one class of stock.

- Incorporator: This is the person who files the Articles of Incorporation. The Articles of Incorporation should be filed in the state where the corporation is located. Most states require that you file the Articles of Incorporation with the Secretary of State’s office; however, this can vary from state to state. Typical filing fees can be between $50 to $800. It just depends on your state’s filing fees. Be sure to visit your state’s online business portal to know where you should send your Articles of Incorporation.

Step 4: Create corporate bylaws

Corporate bylaws are legal documents written and adopted by the owners and board of directors when a corporation is incorporated or formed. Although these bylaws may vary from corporation to corporation, here are some of the basic components:

- Business name, purpose, and location

- Members

- Board of Directors

- Committees

- Officers

- Meetings

- Conflict of Interest

- Rules to any amendments to bylaws

- How the company will operate

- Duties and responsibilities of the owners

- Internal management structure

- Shareholder ownership rights

- Annual Meetings

- Rules for selecting and removing directors and officers

Even though not legally required in every state, they are very beneficial to companies. They are beneficial because they set the guidelines and processes that the owners and board will use to run the business.

Bylaws create corporate structure

Additionally, they define the structure of the corporation by specifying the rights, duties, and responsibilities of all members. These set the rules for the corporation. They note the rules that govern the corporation and note how those in charge are nominated, elected, and removed.

Each corporation also needs to set up a comprehensive corporate records book, which should include important papers. These important papers can include the minutes for director and shareholder meetings, stock certificates, business transactions, and more.

Lastly, when the corporation drafts the legal documents, they should consider rules regarding general operations, stock, shareholders, and more.

We can help you create bylaws

ZenBusiness helps corporations create their own bylaws with a customizable template. Having a well-written, comprehensive list of corporate bylaws is crucial to starting a functional corporation. The ZenBusiness template can help you create an all-encompassing list, without the added stress of wondering if you forgot something important.

Draft a shareholder agreement

A shareholder agreement is an arrangement among a company’s shareholders that describes how the company should operate and defines the shareholders’ rights and obligations. Shareholder agreements, along with their rights and any of their transactions, should be stored with the other corporate documents.

The shareholder agreement is intended to ensure that shareholders are treated fairly and that their rights are protected. It also enables shareholders to make decisions about potential shareholders in the future. Additionally, it provides a safeguard for minority positions. Most shareholder agreements will include:

- A preamble, which identifies the company and its shareholders

- A list of recitals (rationale and goals) for the agreement

- Optional vs. mandatory buying-back of shares by the company if the shareholder wants to give up their share

- A right of refusal clause explains how the company has the right to purchase a shareholder’s securities before they sell to an outside party

- A fair price for shares, which will be recalculated annually or via a formula

- If there is an insurance policy, it could be explained in full

Secure your corporation with a shareholder agreement

Corporations should have a shareholder agreement because it can ensure a secure corporation. Without a shareholder agreement, you could run into trouble if the business venture doesn’t go as planned or shareholders are caught up in personal issues.

Determine funding and shareholder rules

When you start doing business, it’s important to draft a shareholder agreement to determine the corporation’s funding, set rules for removing inactive shareholders, and resolve any disputes. Essentially, a shareholder agreement protects the corporation and involved individuals.

Step 5: Issue shares of stock

Issued shares are authorized shares sold to and held by company shareholders. Companies must record the number of issued shares on a balance sheet and list the shares under owners’ equity or capital stock. Companies must then list the number of issued shares to the Securities and Exchange Commission (SEC) in their quarterly filings.

Issued shares include the stock that the company publicly sells, which generates capital, and the stocks given to insiders as part of their compensation packages. Stock shares are only issued once.

After they are first issued, investors can sell shares to other investors. Companies can also buy back their own stock. Afterward, the shares are listed as “issued” even though they will become “treasury shares.”

Facts about Issued Shares:

- Shares may be shown in the company’s annual report.

- They’re used when calculating the market capitalization and earnings per share.

- Help investors and analysts measure the company’s value.

Private vs. Public Companies

Private companies are privately held, most commonly by the company’s founders, management, or private investors. Although private companies cannot rely on selling stocks or bonds, they may still be able to sell a limited number of shares without registering with the SEC. They don’t have to file disclosure statements with the SEC. As a result, they cannot dip into public markets and must turn to private funding.

On the other hand, a public company has sold all, or at least a portion, of itself to the public. Public companies sell this during the initial public offering (IPO), which means that shareholders claim part of the company’s assets and profits.

Public companies can tap into public markets and sell stocks and bonds to raise capital. These companies must file quarterly earnings reports to the SEC since they trade in the U.S. stock exchange.

The SEC promotes disclosure and sharing of market-related information, fair dealing, and protection against fraud. Public companies must track and report stock to the SEC to avoid repeating a complete stock market crash.

Step 6: File for an EIN and review tax requirements

An Employer Identification Number (EIN) is used to identify the business entity with the federal government. Corporations may need an EIN and must apply online. Applying for an EIN is a free service that is offered by the IRS. Applications can be completed by mail, fax, or online.

You will need to apply for an EIN if any of the following statements apply to your corporation:

- The Secretary of State gives a new charter to your corporation

- Your corporation changes to a sole proprietorship or a partnership

- A new corporation is developed following a statutory merger

- If you become a subsidiary of a corporation

Apply for necessary business permits or licenses

An additional step some corporations may need to take is to apply for all necessary licenses and permits from federal, state, and local agencies. Requirements and fees will vary based on location, business activities, and local government rules. Depending on your business activities, your corporation may need federal licensing or permits.

Common business activities that require federal permits and licenses include agriculture, alcoholic beverages, fish and wildlife, radio and television broadcasting, and more.

Licenses and permits from the state, county, or city depend on your business activities and location. Every state requires your corporation to have at least one type of business license. States typically regulate a larger range of business activities when compared to the federal government.

Common state-regulated activities are plumbing, restaurants, retail, and dry cleaning. Depending on your state, county, and city, you might need specific requirements, so it’s recommended to visit your state’s website.

Submit your corporation’s first report

Some states will require you to submit an Initial Report after incorporating. Your corporation will need to pay fees shortly after forming or incorporating. Typically, you will need to file the initial report within 30 to 90 days after registering the business with the state.

Many states do not require an Initial Report. The Initial Report is due to the Secretary of State. Since no state is the same, the Initial Report fees may vary. In Washington, for example, the Initial Report fee is $10.

Typically, you will need the corporation’s name, registered agent information, the address of your principal office, contact information, the nature of the business, and the names of appointed directors, members, stockholders, or trustees.

Check with the state where your corporation is registered to learn the rules for filing your first report. ZenBusiness can help you file your Initial Report and the annual reports following it.

We can help

We offer fast, accurate corporation formation online guaranteed. Our services provide long-term business support to help you start, run, and grow your business. You can rely on us to create your corporation today.

If starting a corporation feels like an uphill battle, we can reduce your stress. Let us take care of formation, compliance, and more. That way, you can get back to building your dream business.

More Information on Incorporating Your Business

Types of Corporations

Before you start a corporation, it’s important to know these three common corporations and their use cases:

- C corporation

- S corporation

- Nonprofit corporation

C Corporation

A C corporation (C corp) is a type of corporate structure that offers the strongest legal protection to its owners. Registering a C corp is the most common way to form a corporation. Follow the steps below as we walk you through starting a corp.

Filing as a C corporation is a legal procedure that allows corporations to profit and be taxed accordingly. Although C corporations protect their owners from personal liability, they need extensive record-keeping, reporting, and operational processes. Not familiar with C corps? See a full C corp definition.

Advantages and Disadvantages of a C Corporation Formation

If you want to raise money for your business concept and sell shares to investors, you’ll want to incorporate as a C corporation.

C Corp Advantages

- Limited liability: You are generally not responsible for the debts of the corporation. If someone sues the corporation, they usually can’t go after the personal assets of the shareholders.

- Ability to issue shares: Your corporation can sell shares to investors to raise money.

- Unlimited number of investors: This is important for growth.

- Unlimited classes of shares: Issuing classes of non-voting or limited voting shares allows you to keep control of the corporation.

- Ability to go public: You can become a public corporation, selling shares in the stock markets.

C Corp Disadvantages

- Higher cost: The corporation is more expensive to maintain and administer because compliance with regulations means keeping extensive records.

- Double taxation: Corporation income is taxed at the corporate rate, and dividends issued to shareholders are taxed at the individual income tax rate.

- Losses are not deductible: Business losses can’t be deducted from owner/shareholder income.

If the pros and cons don’t help you decide how to incorporate, do more research on sites such as ZenBusiness. If you’re sure you need a C corporation, then you should start the incorporating process.

Ready to start a C corp? We offer fast, reliable formation, and we’ll set up a C corp for you. We’ll also help you start, run and grow your business over time.

Shareholders’ Relation to the C Corporation

C corporations are structured so that if a shareholder decides to leave the company and/or sell their shares, it can remain undisturbed. The lives of shareholders and the corporation are completely independent of each other. Because of this structure, C corporations are a great choice for medium- to high-risk businesses or businesses that plan to be sold or “go public.”

Nonprofit Corporation

A nonprofit corporation is designed to do charitable, religious, educational, literary, or scientific work. Nonprofit corporations work for the public and can receive tax-exempt status, which means they do not pay state or federal taxes for any income or profits.

In addition to following rules that are very similar to a C corporation, they also follow a special set of rules about what to do with any profits.

S Corporation

An S corporation (S corp) is not a business entity. It’s a tax selection that you can make as a corporation or LLC. It is designed to avoid the double taxation issues of C corporations. Taxes can be passed directly through the owners’ personal income, avoiding corporate tax rates. Most states recognize S corps the same way that the federal government does and tax shareholders according to those laws.

S-Corps are not all taxed the same

Since each state can set its own laws for corporations, not all S corps are equally taxed. For example, some states do not recognize S corporations, taxing them like C corporations. In other cases, certain states might tax S corporations in profits above a specified limit.

What are the costs of forming a corporation?

Common fees and expenses to expect:

- Article of Incorporation filing fee: $100 to $250

- Government filing fee: $50-$200 (Depending on which state you live in and the type of business you have, you may have to pay additional fees to your state.)

- Attorney fee: $50 to $300 per hour

- Tax preparation fee: Approximately $1,000 for the preparation of a corporate return

Additionally, you should expect annual fees, which will change depending on the state. Corporations usually have to pay a few hundred dollars. Several factors will impact the cost of forming a corporation. If you are forming a nonprofit organization, you might find fees between $20 to $195.

Otherwise, annual fees fall somewhere between $45 to $315, depending on your state. When budgeting for annual fees, you should also consider recurring costs, like an annual report.

ZenBusiness offers solutions to help you get your corporation up and running quickly. We offer low-cost services and expert support to help form your corporation and remain compliant with state and federal laws. Our affordable plans can help you eliminate any first-time business difficulties.

How is a corporation taxed?

C corporations are taxed corporate income tax on any corporate profits. In the eyes of the IRS, C corporations are recognized as separate taxpaying entities. Additionally, the owners of the corporation will also pay personal income tax on corporate profits. This creates the issue of double taxation.

On the other hand, S corporations report the corporation’s income and losses on their personal tax returns. As a result, S corporations’ taxes are assessed by their individual tax rates, ultimately avoiding the double-taxation conundrum.

Corporate taxes can be beneficial for business owners, as corporate tax returns deduct medical insurance and fringe benefits. Additionally, corporations can deduct losses more easily. Lastly, any earned profits can be left within the corporation, enabling corporations to plan taxes, leaving more room for potential tax advantages.

Check out our article for more in-depth information on How corporations are taxed.

Start your corporation today with expert help

We offer low-cost services and expert support to help form your corporation and remain compliant with state and federal laws. Our plans are affordable and can help you eliminate any first-time business difficulties. We’ve helped over 500,000 customers form their dream business.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your Corporation

Enter your desired name to get started

Incorporating FAQs

-

The processing time for forming a corporation varies by state, particularly when filing online or by mail. Be sure to visit your state’s site for processing times and corp status

-

No. You can form a corporation yourself. There is no requirement to use a lawyer. Some people may feel more comfortable consulting a business attorney, though.

-

It is usually best to form your corporation in the state where your business is located. Unless the specifics of your business indicate otherwise, there are ordinarily no great advantages to forming your corporation in any other state.

-

An LLC is a limited liability company. LLCs are a legal entity separate from individuals, like a corporation. However, corporations are also tax entities. Corporations, for instance, are taxed differently than individuals.

-

Yes. “Inc.” is the abbreviation for “Incorporated.” Incorporated companies are corporations. “Inc.” is a designator, similar to “Co.” or “Corp.”

-

Corporations can be dissolved in the state in which the corporation is located. To dissolve the corporation, you must fill out the Articles of Dissolution from your state. Depending on your specific state, they may require additional documents like a tax clearance certification.

-

Forming a corporation can help you save money in the long run and protect your business. The benefits of forming a corporation include:

- Protect personal assets from any business risks

- Establish an official business in the eyes of your state and potential clients/customers

- Recognized outside of the U.S.

- Allows stock to be issued

-

Although there are many advantages to forming a corporation, there are also some cons. The disadvantages of incorporating include:

- Double taxation

Double taxation is notably one of the biggest disadvantages of a corporation. In the case of double taxation, a corporation is taxed at the corporate level, and if it’s distributed to shareholders, they have to pay taxes on it. - Rigid management system

Corporations also come with a rigid management system, which means they will be made up of shareholders and a board of directors that will call the shots. - More extensive reporting and bookkeeping

Although the rigid structure provides some direction to the corporation, it also comes at the cost of additional reporting and bookkeeping, making it a stricter form of business than other structures.

- Double taxation

Create a C Corp FAQs

-

Yes, a C corp can have ownership of an LLC. If you’d like to do this, then be sure to keep separate accounting books to keep track of each structure’s finances.

Liability might also become an issue, so be sure to reach out to a business attorney for this matter.

-

Yes, you can change your C corp status to something else, like an S corp. If you plan to adopt an S corp designation, then make sure to file IRS Form 2553.

As for changing your C corp into another business model, you may need to speak with a business attorney for more information and steps.

-

Yes, one person can start a C corp. In fact, a C corp can be owned and run by just one person in all 50 states.

You can also be the sole director, officer, and shareholder. However, you’ll still need to follow all the formalities that running a C corp requires.

-

S corps are tax designations, while C corps are a type of business entity. Compare and contrast both in our piece S corp vs. C corp.

-

It depends on several factors. Both provide liability protection, but there are significant differences. Learn about them as we compare LLCs vs. C corps.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

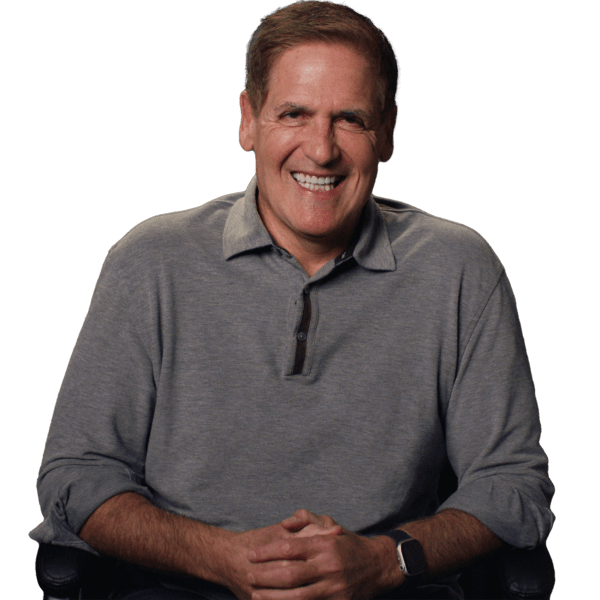

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

Entity Comparisons

Form a Corporation in these States

Ready to Start Your Corporation?