Filing taxes is an annual ritual for Americans, but not everyone follows the same procedure. For some, a website subscription is the go-to method. Others prefer to work with a tax professional to alleviate extra stress. Business owners are no different.

Many of them ask the same questions that individual filers ponder. When is the best time to file? Should I hire a tax professional? How can I streamline the process?

With those questions in mind, in 2020 we surveyed 501 U.S.-based business owners about how they handle their taxes. Read on as we explore their tax struggles.

High Time for Taxes

Our study looked at two types of business owners: those who were self-employed (entrepreneurs) and businesses with additional employees.

Tax season can already be a stressful experience for business owners, but in 2020 the COVID-19 pandemic wreaked havoc. The filing deadline was extended to July 15, 2020, to offer some relief to Americans. Though 55.8% of business owners reported that they filed their taxes prior to the original deadline, 26.1% said they filed after April 15. Another 18.1% said they had yet to file as of July 7.

While a significant portion of business owners reported taking advantage of the extension, many reported wanting more support. 52.8% of business owners said they didn’t think the government did enough to support them with filing their taxes during the pandemic.

The Filing Process

Whether business owners were only filing for themselves or had employees, they spent about half a workday dealing with tax-related paperwork. Self-employed individuals took a median of four hours to prepare to file, but businesses with at least one employee other than the owner needed an extra hour.

Businesses with employees were also more likely to work with a professional to prepare their taxes (51.3%) than self-employed people (30%). However, for companies that were in business four years or less, 67.3% of owners reported that they personally filed. Once a business surpassed four years, though, fewer owners (58.9%) chose to file personally.

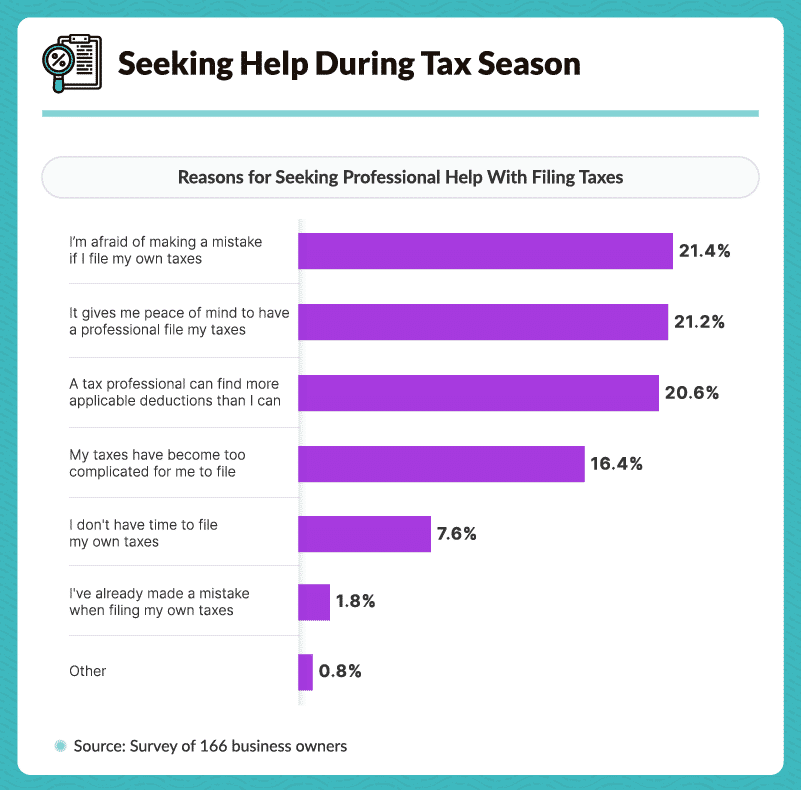

Reasons to Receive Assistance

It’s curious that the longer someone owns a business, the more likely they are to seek outside help with their taxes. Perhaps proprietors are taking off their “tax hat” and handing it to someone else because they’ve made one too many errors over the years.

Of business owners who said they seek help to file their taxes, 21.4% used a tax professional because they were wary of making a mistake. According to the IRS, common tax errors like filing late and failing to legitimize business expenses can cost business owners money in penalties.

This is why the IRS recommends using a credible tax preparer. Entrusting a professional with taxes gave 21.2% of business owners who sought help with their taxes peace of mind. Another 20.6% chose to receive assistance because they knew a professional preparer would be more apt to find deductions.

Is being the boss worth the stress?

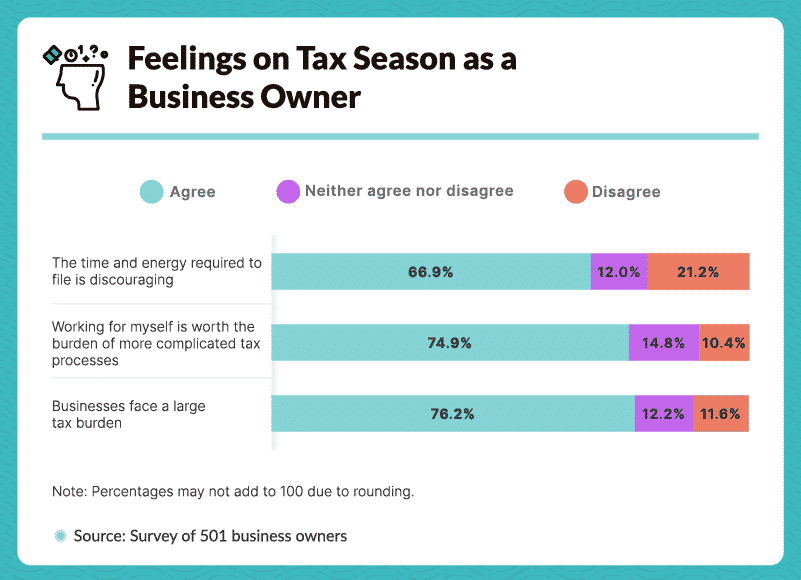

Considering the added hassle that comes with running one’s own business, is it beneficial to pursue entrepreneurial ideas? According to more than two-thirds of business owners in our study, the time and energy required to file taxes are discouraging, but not so much so that they were unwilling to pursue their entrepreneurial desires: 74.9% felt it was worth it to work for themselves despite the complicated tax process.

Research shows that the gig economy is growing. People who work full time tend to enjoy stability, employer-provided retirement plans, and a less-complicated tax-filing process. Those who are self-employed are rewarded with benefits, as well: They’re the boss; there’s no bureaucracy getting in the way of a raise; and, of course, they have the freedom to choose when they work.

However, 76.2% of business owners reported that they faced a large tax burden. Still, the weight of paying sole proprietor or C corporation taxes doesn’t seem to outweigh the benefits of having one’s own business.

Alleviating the Burden

There are steps business owners can take throughout the year to lessen the impact of tax season. The No. 1 way to make tax season more manageable was to save all business expense receipts. Nearly 75% of self-employed people and 81.3% of businesses with multiple employees reported this method.

As previously mentioned, businesses make similar filing mistakes. One of them is failing to appropriately separate business and personal expenses — something that might be more difficult for sole proprietors without a business credit card.

However, 58.1% of those who were self-employed reported that keeping their business and personal expenses separate helped make tax filing more manageable, and three out of four businesses with employees other than the owner echoed the sentiment. Having to comb through a list of hundreds of intermingled expenses can take a toll during tax season.

Other actions business owners reported taking to make tax season more manageable included maintaining a bookkeeping system, using a designated business credit card, and filing quarterly taxes. Some business owners may not know they should pay taxes quarterly. Failing to do so can lead to penalties, and who wants to have to owe more than they need to?

Tax season is manageable

The first four months of the year have a reputation for causing financial stress: People have to scramble to get their documents together, or they’re hard at work to pay the government money owed.

But tax season doesn’t have to drain you or your business of joy and revenue. Our findings show that although about 90% of businesses experience some level of stress during tax season, filing taxes is manageable if appropriate actions are taken throughout the year.

The ZenBusiness Money app can make those actions a lot easier. When all your finances are in the same place, preparing your taxes can be done with the click of a button.

Methodology

We surveyed 501 business owners. All respondents were required to report that they currently run their own business and are living in the U.S.

Respondents were 51.7% men and 48.3% women. The average age of respondents was 39.

Some respondents (40 respondents) reported that while they were a business owner or entrepreneur, they had yet to ever file taxes as a business owner. These respondents were excluded from our visualization of the data in parts of this project and are noted where applicable.

Respondents were asked to report whether their business had employees other than themselves (self-employed with no other employees).

They were also asked to report how long they had been a business owner. In our final visualization of the data, we simplified the breakdown to businesses that had been running for more than four years or four years or less.

Respondents were asked to report whether they personally file their taxes or seek the help of a tax professional to file. Those who reported using a tax professional were then asked their reasoning for doing so. The reasons were presented as a check-all-that-apply question, so percentages will not add to 100.

Respondents were given a group of statements and asked how much they agreed or disagreed with each. They were given the following scale of options:

- Strongly disagree

- Disagree

- Somewhat disagree

- Neither disagree nor agree

- Somewhat agree

- Agree

- Strongly agree

In our final visualization of the data, we combined responses into three broad groups: agree, neither agree nor disagree, and disagree.

All respondents were asked to report what, if anything, they do throughout the year to make tax season easier for themselves. The question was asked as a check-all-that-apply question, so percentages will not add to 100.

Due to the COVID-19 pandemic’s impact on the world, including tax season, we ran a second survey on July 7, 2020, to see how the pandemic had impacted business owners trying to file their taxes. The results are now reflected in the first graphic of this project.

Limitations

The data we are presenting rely on self-reporting. There are many issues with self-reported data. These issues include, but are not limited to, selective memory, telescoping, attribution, and exaggeration.

Fair Use Statement

Tax season can be a stressful experience for anyone, but especially small business owners. If someone you know would benefit from the information in this project, you can share it for any noncommercial use. Please link back here so that the project can be viewed in its entirety, along with the methodology. This also gives credit to our contributors for their hard work.

Disclaimer: The content on this page is for informational purposes only, and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

Tax Information and Resources