How to Start an LLC in Arkansas

Looking to start a limited liability company (LLC)? Arkansas might be the right place for you. With its dedication to economic growth, various tax incentives, diverse geography, and more, the Natural State is a popular choice for new entrepreneurs.

Pair those state-specific benefits with the advantages of the LLC business structure, such as separation of personal assets and liabilities from those of your business, and you’ve got a great match. An LLC in Arkansas can be an excellent way to take advantage of a friendly commercial climate and a business configuration that offers flexibility and asset protection.

However, in order to reap those benefits, you’ll need to officially form your LLC in Arkansas. And if you want to stay in good standing with the state, you’ll need to complete the formation process correctly.

If the idea of forming an LLC seems more stressful than dealing with traffic on Highway 7, don’t fret. We’re here to walk you through the entire process. Along the way, we’ll also explore how our products and services can help cut through much of the red tape and make the whole journey more seamless.

Looking to start a limited liability company (LLC)? Arkansas might be the right place for you. With its dedication to economic growth, various tax incentives, diverse geography, and more, the Natural State is a popular choice for new entrepreneurs.

Pair those state-specific benefits with the advantages of the LLC business structure, such as separation of personal assets and liabilities from those of your business, and you’ve got a great match. An LLC in Arkansas can be an excellent way to take advantage of a friendly commercial climate and a business configuration that offers flexibility and asset protection.

Just one note before you hop in. These directions apply only if you want to start a domestic, for-profit LLC in Arkansas. Foreign LLCs, or LLCs that are formed outside of Arkansas but will do business in the state, must follow a different process. Similarly, a Professional Limited Liability Company (PLLC) has unique filing requirements compared to a typical Arkansas LLC. However, we have a separate article to help you learn more about forming an Arkansas PLLC. Now, let’s get started.

Starting an LLC in Arkansas

To start an LLC in Arkansas, you’ll need to file a Certificate of Organization with the Secretary of State. Before you can file these formation documents, however, you’ll need to name your Arkansas LLC and appoint a registered agent. After your Certificate of Organization is filed, you’ll create an operating agreement and obtain an Employer Identification Number (EIN).

Arkansas LLC in 5 Steps

Every business has different needs, but forming an LLC in Arkansas generally requires completing five main steps. Keep reading to discover a full breakdown of each one, as well as a few things you need to consider throughout the process.

Step 1: Name your Arkansas LLC

To start an LLC in Arkansas, begin by naming your company. For obvious reasons, every business requires a name before registering with the state. Picking a name for your LLC in Arkansas is one of the most fun, exciting, and important parts of the formation process.

Start by taking some time to brainstorm a few ideas. Your business name should adequately convey what your LLC offers, while capturing the right branding voice for your company/industry.

Take a moment to see our tips and tricks for naming your LLC.

Arkansas LLC Naming Conventions

Arkansas has a few naming conventions that you have to follow. Specifically, your LLC’s name must:

- Be distinguishable from the name of any other business that is on file with the Arkansas Secretary of State

- Contain the phrase “limited liability company,” “limited company,” or

- Include one of the following abbreviations: “L.L.C.,” “LLC,” “L.C.,” or “LC.”

Check to see whether your desired business name is available by using our Arkansas Business Entity Search. You should also search for your business’s name on the Arkansas Secretary of State’s website. Finally, you can call the Arkansas Secretary of State’s office directly.

Note: It’s always a good idea to come up with a few potential names (or at least one backup), so you have multiple options in case the name you want is already taken.

Trademarks

Even if the name you want to use appears to be available after you’ve searched the Secretary of State’s database, there’s no guarantee that someone hasn’t already trademarked it at the state or federal level. While there’s no central place to check for all trademarks (some businesses even consult with trademark-specialized lawyers), you can take some measures yourself.

For instance, you can search for state-level trademarks through the Arkansas Secretary of State. To check for federal trademarks, search the United States Patent and Trademark Office (USPTO) database. You can also apply for your own state trademark via the Arkansas SOS.

In addition to checking state and federal databases, it’s a good idea to conduct extensive internet searches for your desired business name, including checking domain names, social media sites, and even phone directories.

Reserving a Business Name for your Arkansas LLC

Starting an LLC takes time and planning. If you have the perfect name for your LLC but aren’t ready to form it yet, consider reserving the name instead. That way, no one else can take it before you’re ready to register your business. With our name reservation service, you can reserve your ideal LLC name for up to 120 days while you get ready to launch your company.

Choosing a Domain Name for your Business

All modern businesses need an online presence to attract customers and maximize their market share. Consequently, it’s a good idea to make sure you can find an online domain name that matches your LLC’s name. Register the perfect domain name for your business here.

Filing for a Fictitious Name

Sometimes, businesses can benefit from having an extra name. These names allow commercial ventures to enjoy some versatility while solidifying their reputation with their customers. Most states call these alternative monikers “doing business as” names (DBA names), but Arkansas simply refers to them as “fictitious names.”

Examples of when a fictitious name would be used include:

- A business with the official name “ABC Toys, LLC” wants to sell online as “ABC Toys”

- A business with the official name “XYZ Computers, LLC” wants to sell MacBooks as “XYZ Macs”

If obtaining a fictitious name sounds right for your situation, you’ll need to file an Arkansas Application for Fictitious Name with the Arkansas Secretary of State. Learn more about this process with our step-by-step guide on how to get a DBA name for your business in Arkansas.

Name your LLC

Enter your desired business name to get started

Step 2: Appoint a registered agent in Arkansas

Appoint a registered agent for your Arkansas LLC. Also known as an agent for service of process, a registered agent is an individual or business that accepts important legal notices on behalf of the business. All LLCs in Arkansas are required to have a registered agent.

Arkansas Registered Agent Requirements

To serve as a registered agent in Arkansas, an individual or business must:

- Have a physical address within Arkansas (must be a physical street address, a P.O. box will not suffice)

- Be available during regular business hours to accept all incoming documents and forward them to the LLC

- Examples of critical documents include lawsuit notices, other legal documents and service of process notices, notification of annual report deadlines, and tax forms.

Can I serve as my own registered agent?

While there’s no law prohibiting LLC owners from serving as their own registered agent, there are several reasons why this isn’t the best idea.

For starters, if your business moves or the address you have on file changes, you’ll need to remember to change the registered agent address with the SOS. Furthermore, having to be available during all regular business hours to receive legal notices can prove to be inconvenient.

Perhaps most importantly of all, being served with notices such as lawsuit notifications in front of customers or others can be incredibly embarrassing and distressing as a small business owner.

Benefits of a Registered Agent Service

Rather than serving as your own registered agent or asking a friend or family member to do so, many business owners opt to use a professional registered agent service. This approach offers several advantages.

For one, you have more important things to do than sit in an office waiting for documents to arrive. Second, making a mistake (notably, not being present to receive a notice) as a registered agent can be costly. Failing to respond to government notices can lead to fees, sanctions, and lawsuits. Those are the last things your business needs.

And, of course, using professional services will help you avoid the aforementioned embarrassment of being served with legal notices in front of others.

If you’re looking for a quality registered agent service, then look no further. Let us help you get a registered agent in Arkansas.

What if the state can’t find my Arkansas registered agent?

A registered agent in Arkansas has one primary job: be present to accept important correspondence. Unfortunately, registered agents are unavailable more often than you might think.

This can happen for a variety of reasons. Sometimes your registered agent may go on vacation or become sick without notifying anyone.

Whatever the reason, if the registered agent is unavailable, a whole host of negative outcomes can follow. At the very least, your business will miss out on critical legal and business notices. Furthermore, you may fall out of good standing with the state of Arkansas. The state may even take action against you and your business if it can’t contact your registered agent. In some situations, it may initiate a lawsuit against your LLC or impose financial penalties. In the worst case scenario, the state may dissolve your LLC entirely for failing to meet the state’s requirements for LLCs.

ZenBusiness can provide your registered agent service

With all of the potential consequences should the state not be able to contact your registered agent, it’s no surprise that so many business owners opt to use professional registered agent services instead.

By letting ZenBusiness provide your registered agent, you can ensure that important legal notices will be received and passed along in a timely manner. Your registered agent address will also always remain reachable and up-to-date with the Secretary of State, helping you stay compliant. Finally, you can avoid the potential embarrassment of being served with lawsuits or other legal notifications in front of others.

Step 3: File Arkansas Articles of Organization

File your Arkansas Certificate of Organization. This formation document officially registers your Arkansas LLC with the state, so it’s important to complete it accurately. Mistakes can delay the formation of your LLC or lead to several administrative consequences. Fortunately, we can take care of the filing process for you with our LLC formation service. Check out our LLC formation plans.

The state filing fee to file an Arkansas Certificate of Organization is $50 (as of this writing). If you choose to use our LLC formation plan, you can opt to expedite our processing speed for an extra fee. Normal processing time for our filings is 2 to 3 weeks. For an extra $50, you can reduce our processing time to 6 to 9 business days. And for an extra $100, you can further shrink processing time to 2 to 5 business days. To learn more about Arkansas’s other LLC fees, see our guide to Arkansas LLC costs.

What information do I need to include in my Arkansas Certificate of Organization?

When you fill out your Arkansas Certificate of Organization, you’ll need to provide:

- The name of your Arkansas LLC

- Your business address

- The name and address of your registered agent

- The name and address of at least one officer for franchise tax purposes

- Organizer signature(s)

Amending and Updating your Certificate of Organization

Even if you accidentally filed your LLC’s Certificate of Organization incorrectly, we can give you a hand. Our amendment filing service lets you easily make changes and updates to your business’s name and address. You can also tweak your ownership structure and the name and address of your registered agent. Moreover, you can opt to use our Worry-Free Compliance service. This service can help you stay compliant with all of the annual filing requirements in Arkansas. It also gives your business two free yearly amendments so you can update your business’s Certificate of Organization when the occasion requires.

Member-Managed or Manager-Managed?

LLCs commonly have two forms of management. With member-managed LLCs, the owners (or members) exercise control collectively over the company’s decisions. Alternatively, an LLC can opt for a manager-managed structure by appointing one or more of the members to manage the LLC, or hiring an outside manager.. In Arkansas, LLCs are member-managed by default, and most LLCs begin operations as member-managed enterprises.

Step 4: Create an operating agreement

Create an operating agreement for your business. While not required by Arkansas law, this document lays out all pertinent details regarding how your LLC will be run. Operating agreements also further help to protect your personal assets by showing the court that you took time to draft this formal document for your business. They can even help attract investors and future business partners.

What do operating agreements include?

Operating agreements help clarify things like:

- How ownership of the LLC is divided among the members

- How profits are divided

- How members or partners can enter and exit the business

- Under what conditions the business can terminate

- How the business should wind up (as part of the termination process)

- The voting rights of the LLC’s members or partners

- How the business’s members make important decisions

- Your LLC’s management structure (member-managed or manager-managed)

Take a few moments to learn more about the incredible benefits of operating agreements. Without an operating agreement, your business will have to follow Arkansas’s default guidelines in the state’s Uniform LLC Act. These default provisions might not align with what you and the other members want for the business.

✓ Operating agreement template

Once you’ve decided to draft an operating agreement, you may be wondering where to start. What provisions should you include? These are the kinds of questions we love to solve. Our LLC operating agreement template gives you the framework for filling out this all-important document. With our interactive template, you can address issues like the division of profits and losses, the ownership structure of the LLC, and each member’s rights and responsibilities.

Do I need an operating agreement even if I’m the only owner?

If you’re going into business on your own, you may find it tempting to avoid drafting an LLC operating agreement altogether. After all, why worry about avoiding disputes when there’s no one to have a dispute with?

Nevertheless, sole owners should still consider drafting an operating agreement for several reasons. First, having an operating agreement allows you to bring in new members on your terms. By having an operating agreement on hand before you bring on new members, you won’t need to worry about negotiating an agreement with them.

Furthermore, investors and business partners alike will use your operating agreement to size up your business. On top of that, many banks require you to have an operating agreement before getting a business bank account with them. And if you are somehow incapacitated, a third party can use your operating agreement to determine how to manage the LLC until your return.

Finally, in the event that you find yourself in a business lawsuit, an operating agreement can serve as valuable evidence that you and your business are, indeed, separate entities. In essence, it makes your business look more “official.” Without an operating agreement, the court may view your LLC more like a sole proprietorship.

Step 5: Apply for an EIN

Register your company with the federal government by obtaining an Employer Identification Number (EIN). Much like a Social Security Number (SSN) does for individuals, an EIN identifies your business to the Internal Revenue Service (IRS). And just as individuals place their SSNs on their tax returns, businesses use their EIN to file taxes with the IRS. In addition to streamlining tax payments, EINs allow your LLC to hire new employees and get a business bank account.

While single-member LLCs with no employees that opt to be taxed as sole proprietorships usually aren’t required by law to obtain an EIN, it’s a good idea to get one anyway. Most banks require an EIN to open a business bank account, and investors may be more confident in your company if you have a business bank account.

Want to get an EIN without dealing with the IRS? We understand completely. Let us handle the hassle for you with our quick and efficient EIN service.

Get a business bank account

As we’ve mentioned, getting a business bank account is a crucial step for anyone starting an LLC. Keeping your business funds in a business bank account is a fantastic way to solidify your business’s limited liability and help protect your assets by separating your personal expenses from those of your business.

To make things even easier for you, we’ve partnered with Lending Club to offer a discounted bank account. With this account, you can get unlimited transactions, online banking, a debit card, and more.

And if you’re looking for even more help managing your finances, check out ZenBusiness Money. This innovative platform enables you to create and send custom invoices, track tax-deductible expenses, and manage all other financial aspects of your small business.

Does Arkansas LLC have a publication requirement?

No. Unlike a few other states, there’s no need to publish the news of your LLC’s formation in a local newspaper or gazette.

Handling State Taxes

Arkansas requires all businesses — including LLCs — to pay the state’s yearly franchise tax. This is done by filing an annual franchise tax report and paying the fee ($150 for LLCs).

When filing your annual LLC franchise tax report, make sure you have your LLC’s management and registered agent information handy. And be extra careful to submit your LLC’s franchise tax report on time (it’s due on or before May 1, each year). Late filing can lead to penalties, interest, and even legal consequences.

If you plan to hire employees to work for your LLC, you will need to file for Arkansas Workers’ Compensation Insurance and withhold your employees’ income taxes. To get started, register for withholding tax with the Arkansas Department of Finance and Administration.

Finally, if your LLC plans to sell products to Arkansas customers, you will need to collect sales and use tax. As with withholding taxes, the first step in paying sales tax is registering with the Arkansas Department of Finance and Administration.

We can help

Knowing how to get an LLC in Arkansas is the most important part of the formation process. But knowing the process and working through the process are two different things. We are dedicated to making it easier for entrepreneurs to start, run, and grow their businesses in the Natural State.

Our wide variety of services can handle almost any business need that comes your way. From formation to compliance, and everything in between, we’ve got your back. Whether you want to start your LLC in Little Rock, Hot Springs, or the heart of the Ozarks, we’re ready to help.

Disclaimer: The content on this page is for informational purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your LLC in Arkansas

Enter your desired name to get started

Arkansas LLC FAQs

-

Unlike some states, Arkansas doesn’t require every business to obtain a general business license. However, some localities may insist you obtain a municipal or county business license. The list of business licenses and permits you must acquire depends on your LLC’s individual characteristics. In what industries does your LLC operate? What kinds of products does it sell? When and where does it operate?

Whatever the answers to these questions, it’s likely you will need permits and licenses from various authorities at the federal, state, and/or local levels. Discovering all the permitting and licensing requirements for your business can be overwhelming. But we can give you some peace of mind with our convenient business license report. This tool provides a concise summary of the licenses you need to operate legally in Arkansas. Our report includes not only federal and state permit requirements, but also local and county ones as well!

-

The amount of money you need to start an LLC in Arkansas varies on several factors. At the very least, you will need $50 to file a Certificate of Organization. Note that filing fees can vary from time to time. To obtain the most recent list of fees, visit the Arkansas Secretary of State website.

On top of the $50 in filing fees, you will need to spend significant time going through the formation process. If you are willing to trade your time for a small amount of extra money, we can help you save a tremendous amount of time with our formation services. Learn more about the costs associated with starting an LLC in Arkansas.

-

The most significant benefit of LLCs in Arkansas is that they offer both liability protection and favorable tax treatment. By way of comparison, corporations offer favorable asset protection at the cost of subpar tax treatment (double taxation), and sole proprietorships provide pass-through taxation without any form of limited liability protection. LLCs can also help their owners design their own custom operating procedures and choose from a versatile range of ownership structures.

-

The IRS treats LLCs as pass-through entities by default. This means the LLC itself isn’t taxed. Instead, the LLC’s owners (members) pay taxes on their business earnings at the individual level. Your ownership share in the LLC determines the amount of taxes you pay for your LLC. For instance, if you own 50% of the LLC, you’ll be responsible for paying 50% of the taxes.

Pass-through taxation stands in contrast to double taxation faced by corporations, where the government imposes taxes both at the business level and at the individual level.

While most LLC owners embrace pass-through taxation, there are two possible alternatives. First, LLCs can choose to pay taxes as a C corporation. They can also try to pay taxes as an S corporation. Paying taxes as an S corporation allows LLCs to receive pass-through taxation treatment while also obtaining certain employment-related tax savings. However, there are cons to electing S corporation tax treatment. Specifically, the IRS places more restrictions on companies that identify as S corporations. It also keeps a closer eye on those companies’ financial activities. To learn more about what taxation approach is best for your LLC, you should consult a tax professional.

Aside from federal taxes, LLCs have to pay various state taxes. First, LLCs have to pay Arkansas’s annual franchise tax. Depending on their activities and situation, Arkansas LLCs may also have to pay state withholding taxes, sales and use taxes, unemployment insurance taxes, and good-specific taxes. Finally, your LLC may be responsible for paying certain local and municipal taxes depending on its location.

-

According to the Arkansas Secretary of State’s website, the estimated processing time is between 2 to10 business days. However, COVID-19 may cause delays in processing times.

-

No. It’s not a requirement to file your LLC’s operating agreement with the Arkansas state government. But, because your operating agreement is vital to your LLC’s daily operations, keep at least one copy saved in a safe place. Note: If you’re a ZenBusiness customer, you can keep digital copies of your operating agreement and other important documents stored safely in your dashboard!

-

Most business owners decide to take advantage of an LLC’s pass-through taxation so that they pay state and federal income taxes on their personal income rather than at the organizational level. For single-member LLCs, this usually means being taxed as a sole proprietor. And for multi-member LLCs, this means being taxed as a partnership.

That said, some LLC owners may decide to file taxes as a corporation. While not the ideal choice for all LLC owners, adopting this approach has advantages for some LLCs. Reach out to a qualified tax expert to learn more about how different tax treatments will affect your tax picture.

-

Yes. Arkansas state law allows business owners to operate a series LLC. If you haven’t heard of the concept before, a series LLC features a “parent” LLC that serves as the base for several subordinate, or “child,” LLCs. Each child LLC under the parent LLC operates independently. In addition, each child LLC has asset protection, so the liabilities of one child LLC can’t impact the other child LLCs. Think of it like a tree, with the master LLC being the tree trunk and the individual series LLCs being separate branches. Note: ZenBusiness does not offer Series LLC formation services at this time.

-

To dissolve an Arkansas LLC, you’ll file a Statement of Dissolution with the Arkansas Secretary of State. Make sure you include the appropriate fee. However, there are other steps you should take before you file a Statement of Dissolution. For instance, you’ll also need to submit your Final Franchise Tax Report and follow any protocols for winding up set forth in your operating agreement. See our guide on dissolving your Arkansas business to learn more about winding up your business properly.

-

One of the benefits of an operating agreement is that it allows you to determine in advance how ownership transfer works in your LLC. If you have an operating agreement in place, it should contain directions for transferring ownership. If your operating agreement doesn’t contain those instructions, you’ll have to follow Arkansas law by default.

Generally speaking, a member’s rights usually can’t be transferred without the approval of all the other members. In addition, depending on the exact situation, transferring ownership may trigger a change in your LLC’s membership. Arkansas requires LLCs to report some changes in management to the state.

While Arkansas law does not require companies to report its owners to the Secretary of State, you do need to report your management structure. Therefore, if a change in ownership also changes the management structure, you’ll need to report it to the Secretary of State. Learn more about transferring ownership of an Arkansas LLC.

-

Yes. However, Arkansas refers to DBA names as “fictitious names.” To obtain a fictitious name, apply for one with the Arkansas Secretary of State.

-

The answer depends on your operating agreement. If you have an operating agreement that addresses the issue of removing a member, you must follow that procedure unless it violates Arkansas law. If your LLC doesn’t have an operating agreement that touches on this issue, you’ll have to follow the default procedure in Arkansas’s Uniform LLC Act.

-

Yes and no. Arkansas LLCs must pay an annual franchise tax on or before May 1 of every calendar year. The forms for these franchise taxes essentially serve as the state’s version of annual reports. Outside of these annual franchise tax reports, there is no annual report requirement. Even though they are a bit different from other states’ annual reports, we can help you prepare to file Arkansas annual franchise tax reports with our annual report service.

-

Technically, you aren’t required to have a business plan for your LLC. However, it’s definitely a good idea to create a business plan before you start an LLC in Arkansas. That’s because a well-written business plan serves as a roadmap for your new small business. This document can even help you acquire funding from banks or potential partners. Learn more about creating an effective business plan and find a step-by-step template here.

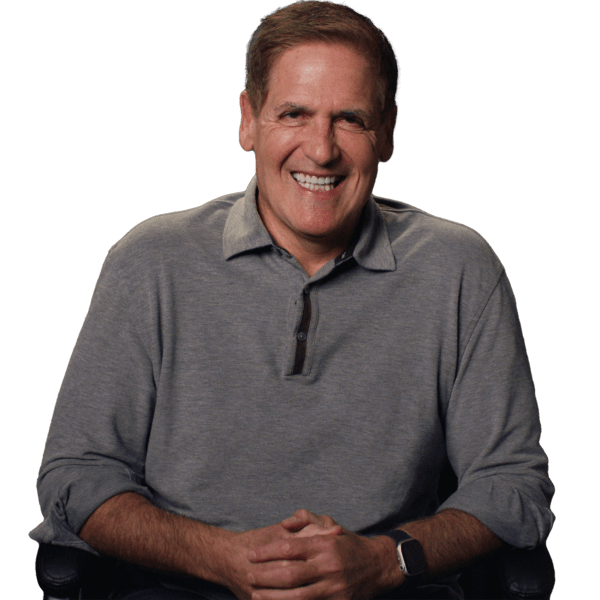

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

Arkansas Business Resources

Start an LLC in Your State

When it comes to compliance, costs, and other factors, these are popular states for forming an LLC.

Ready to Start Your LLC?