How to Start an LLC in New Hampshire

So you’re looking to start a New Hampshire LLC? Ah, the Granite State — where the hills are alive with the sounds of small business potential and not just bike rallies in Laconia or skiing at the White Mountains. While the state may be a playground for outdoor enthusiasts, New Hampshire also happens to be a pretty solid place to lay the cornerstone for your enterprise.

Sure, CNBC gave the state a gold star for business friendliness, but let’s be real: navigating the maze of limited liability company (LLC) requirements here isn’t the same as a breezy day on Lake Winnipesaukee. This guide is like your roadmap, sans potholes, leading you through the New Hampshire-specific legal maze you’ll need to get through.

Starting an LLC in New Hampshire

Before you sling coffee near the boardwalk in Hampton Beach or offer IT services to students at Southern New Hampshire University, you’ll need to get up to speed on local laws and filings. Unlike ordering a lobster roll, you can’t just point and choose; there are specific steps to follow, papers to file, and yes, boxes to check.Before we begin, this guide is all about setting up a domestic New Hampshire LLC. If you’re looking at a foreign LLC or professional limited liability company (PLLC) ventures, you’ll need a different roadmap.

1. Name your New Hampshire LLC

Pick a name. Before you can form your LLC in New Hampshire, you must choose a name. The business name is one of the most significant pieces of establishing your new LLC. The right name will broadcast your business purpose and culture to your customers. That said, while you can be creative with your name, it must meet specific requirements before you can register it.

Official Naming Requirements in New Hampshire

The New Hampshire Revised Limited Liability Company Act includes particular legal requirements for naming your New Hampshire LLC. Every LLC in New Hampshire must include one of the following identifying suffixes in its name: Limited Liability Company, LLC, L.L.C., or L. L. C.

Also, the name must be unique and available. Your name must be distinguishable from all other business and trade names registered in New Hampshire to be unique.

A name isn’t unique if the only difference is:

- An article

- The plural of the same word

- The same name or word is spelled differently

- An abbreviation instead of the full spelling of the name

- A suffix or prefix added to a word, a variation or derivative of the same word, excluding antonyms and opposites

- A change in the identifying suffix

- Unless the current name holder consents, the addition of a numeric designation

- Differences in punctuation or special characters, unless they change the word’s clear meaning

- Differences in whether letters or numbers follow each other immediately or are separated by spaces

- An Arabic or Roman numeral representing a number or a word representing the same number in the same position within otherwise identical names

As you can see, your name must be truly unique. “Let’s Go Racing” and “L3ts G0 R4cing” don’t pass New Hampshire’s distinguishable test.

In addition, your LLC name can’t imply that it’s organized for an illegal purpose. Words associated with certain licensed professions (doctors, engineers, etc.) and certain institutions (banks, colleges, etc.) will need special permission to be used in your name.

Once you have some ideas, you can complete a business name check with the Department of State website to see if your chosen name is available. If you’re not sure how to do this, use our business entity name search tool to guide you through the steps.

Reserving a Name

When you find a unique name for your New Hampshire LLC, you can reserve it. Reserving a name doesn’t form your LLC, but it grants you exclusive rights to use the name for 120 days.

This isn’t required, but it protects your name while you collect the information you need for your formation documents. The Application for Reservation of Name has a small filing fee. If you need additional preparation time, you can re-file and extend the reservation for another 120 days.

Searching for a Domain Name

Most entrepreneurs know they need a website and email address to promote their business online. When choosing a domain name, consider securing a URL that reflects your business name. The availability of a domain name that’s easy and accessible for your customers might influence your decision. When you find the right one, use our domain name registration service to secure it right away.

Is your New Hampshire LLC name available as a web domain?

An online presence is vital for every new business. When choosing your business name, consider how you want to represent your LLC online. An effective web domain name is one your customers can easily remember, recognize, and access. Perform a search and see if your business name is available. You might also want to search to see if your name is available on social media. Businesses often reach customers through Facebook, TikTok, or Instagram. If the name you want isn’t available as a domain name, it might influence the name you choose for your company.

Check for trademarks

Even if the Secretary of State approves your business name, it’s still possible that someone else has already claimed it with a federal or state trademark. To truly check to see if your business name isn’t trademarked is difficult because there’s no one central place to check.

You can take some measures yourself, like searching the trademark database on the United States Patent and Trademark Office website. This can help you determine if someone’s already claimed a federal trademark on the name you want.

State trademarks are applicable only within the borders of a state. To find out if your desired name has been trademarked at the state level, contact the New Hampshire Secretary of State. If you want, you can also apply for your own state trademark by filing a Trademark Application with the New Hampshire Secretary of State. Registration is effective for 10 years. You’ll pay a filing fee for each application you submit.

It’s also wise to do extensive internet searches for your business name, including checking domain names, social media sites, and online phone directories.

Registering a DBA

If you plan to do business with a name other than the LLC’s legal registered name, you must register a trade name with the New Hampshire Secretary of State. Your trade name, also called a “DBA” or “doing business as” name, should be unique and distinguishable from other registered business names. However, it doesn’t need to include an identifying suffix. Trade name registration is effective for five years, and there’s a filing fee.

Name your LLC

Enter your desired business name to get started

2. Appoint a registered agent in New Hampshire

Designate a registered agent. Before completing your LLC formation, you need to appoint a NH registered agent. A registered agent is a person designated to receive legal notices (such as service of process) and certain state correspondence for the company. When they receive a notice or correspondence, they’ll forward it to you.

Who can be a registered agent for an LLC in New Hampshire?

You can appoint a New Hampshire resident or a corporation, LLC, or limited liability partnership with a registered office in New Hampshire as your registered agent. The registered agent address must be a physical street address and not a P.O. box or something similar. Your registered agent must be available at their business address during regular business hours to receive notices.

If you name yourself or a friend, you could miss important notices if you take a day off, visit clients, or go on vacation. You also risk being served with notice of a lawsuit in front of customers or business partners.

What if the state can’t find my New Hampshire registered agent?

Your registered agent is the contact person for service of process, subpoenas, and certain government notices. If the state can’t find your registered agent, it’ll send the notice by registered or certified mail to the LLC’s principal office. The state may also serve a manager by certified mail or any other method. It’s easy to dismiss or misplace a notice received by mail, so it’s a good idea to keep your registered agent up to date or use a commercial registered agent service.

Using a Registered Agent Service

Some corporations and LLCs exist to serve as commercial registered agents for other businesses. Using a commercial registered agent service allows you to avoid the unfortunate scenarios above. What’s more, you won’t have to change your registered agent address if you move to a new business location.

To simplify things, use our registered agent service, and we’ll connect you with a New Hampshire registered agent.

ZenBusiness can be your registered agent

We know it’s challenging to find the right registered agent. You can search through the Secretary of State’s list of commercial registered agents, or you can let us help. Our registered agent service connects you with a reliable registered agent in your state. And if you choose us as your registered agent, we’ll even keep the related paperwork stored in your dashboard to keep you organized.

3. File New Hampshire Certificate of Formation

Complete and submit the LLC paperwork. To form your New Hampshire LLC, file your Certificate of Formation with the New Hampshire Secretary of State, Corporations Division. We’ll guide you through this step and complete the filing for you when you use our business formation services. And to get you up and running faster, we can provide expedited service to put you at the front of the line.

If you choose to complete the process on your own, follow these instructions for starting an LLC in NH.

Create an NH QuickStart account to file your Certificate of Formation

To file your New Hampshire Certificate of Organization online, you’ll need to create a QuickStart account on the New Hampshire Secretary of State’s website and pay a $102 fee. The filing fee for your Certificate of Formation isn’t the only fee you may need to pay. We’ve listed all the fees for NH LLC registration on our LLC costs page.

Information Needed for NH Certificate of Formation

When you file your Certificate of Formation online, the Secretary of State will ask you to provide:

- The LLC name and business address

- The appointed registered agent’s name and address

- A statement of the company’s purpose or primary business

- Whether the LLC will be managed by the members or a manager

- A list of members and/or managers

- Any other information you want to be public

You can complete the Certificate yourself, or an organizer may file it on your behalf.

Member-Managed or Manager-Managed?

A significant benefit of the LLC is the ability to choose how you want it to be managed. It’s important to make this decision ahead of time so you can list it on your Certificate of Formation.

If your LLC has a few members who want to be involved in decision-making, the member-managed LLC is likely best for you. In a member-managed LLC, the members share responsibility for making business decisions on behalf of the company.

However, if you have passive investors as members, you might want to appoint a manager. In a manager-managed LLC, the manager can be authorized to run the company, make decisions, and sign deals.

What if I need to make changes?

If you make changes to your NH LLC registration, you’ll need to file a Certificate of Amendment and pay a filing fee. Filing an amendment alerts the Secretary of State to the change. We can handle this for you with our amendment filing service. Also, consider our Worry-Free Compliance service, which helps keep you in compliance and includes two amendments a year.

Why would I delay my New Hampshire LLC filing date?

Usually, your Certificate of Formation is effective on the day you file it. This is true even if it takes time for the Corporate Division to process your document.

However, if you aren’t quite ready to open your doors, you can delay the effective date of your formation for 90 days. If you’re opening towards the latter part of the year, waiting to file until January 1 can keep you from owing taxes or needing to file an annual report if you haven’t started transacting business.

4. Create an operating agreement

Draft an LLC operating agreement. Next, create your operating agreement to set rules to control the management of your LLC.

New Hampshire doesn’t require that you file an operating agreement. However, your LLC’s operating agreement is an essential document that governs the business’s internal operations — and it’s always best to have one.

When you draft your own operating agreement, you control how distributions are made, when members can leave or join the company, and what happens if a member dies. If you don’t have an operating agreement, you must follow the default rules in New Hampshire’s law to resolve disputes. Unfortunately, these default rules may not give you the result you want.

Do I need an operating agreement even if I’m the only owner?

While operating agreements generally control disputes between owners, they can also be a helpful document for single-member LLCs. The operating agreement usually provides the procedure for continuing or terminating the business if a member dies or becomes incapacitated. Further, some banks, potential investors, and future business partners will want to see that you have an operating agreement.

In addition, an operating agreement can help protect your personal assets. Sometimes, an interested party can sue the LLC’s members if they have co-mingled their personal and business assets. In that case, your operating agreement can act as evidence that the LLC remains separate from its owners.

If you’re unsure as to how to write an operating agreement for your LLC, we offer a customizable operating agreement template to get you started.

5. Apply for an EIN

Get an Employer Identification Number (EIN). The final step to NH LLC registration is applying for an EIN from the Internal Revenue Service (IRS). In most cases, your LLC needs an EIN to file tax returns, report wage withholdings, and apply for a business bank account. You can apply through the IRS website or use our EIN Service, and we’ll handle it for you.

Register for New Hampshire taxes

By starting an LLC in NH, your business will owe income taxes to the New Hampshire Department of Revenue Administration. You can register for state taxes online through Granite Tax Connect.

Be prepared to file a tax return every year, usually in March, for the Business Enterprise Tax and Business Profits Tax; these taxes apply only to businesses with a certain income threshold, which varies from year to year.

Also, expect to register with the state and federal governments if you’re in a regulated industry, like food service, timber, or tobacco.

For Employers

When your business employs one or more workers, New Hampshire Employment Security requires that you file an Employer Status Report. You must also report all new hires and submit a Quarterly Tax and Wage Report for every quarter you have employees.

Additionally, all New Hampshire employers must have workers’ compensation insurance. Workers’ compensation insurance pays medical and wage benefits if an employee is injured on the job.

We can help

At ZenBusiness, we believe every aspiring entrepreneur should have the tools and support necessary to create a business, which is why we’ve made it easy with our free LLC service. When it comes to New Hampshire LLC creation, you’ll probably have questions throughout the process. When you use our products and services, our team of business experts will be here to guide you on how to start an LLC in New Hampshire.

Likewise, we’ll help keep your business legally compliant and up to date with the required filings throughout every stage. From the White Mountains to Merrimack Valley, Portsmouth, and the Great Bay, we offer specially tailored services to New Hampshire entrepreneurs.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank; Member FDIC. The ZenBusiness Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. Your funds are FDIC insured up to $250,000 through Thread Bank; Member FDIC.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your LLC in New Hampshire

Enter your desired name to get started

New Hampshire LLC FAQs

-

Forming an LLC in New Hampshire doesn’t require obtaining a general business license or collecting sales taxes. However, if you operate in a regulated industry, you may need a license from the state or federal government. In New Hampshire, regulated businesses must register using Granite Tax Connect. Regulated businesses include food service, hotels, restaurants, tobacco, timber, and alcohol.

Apart from those, you still need to make sure your LLC has all the other licenses and permits it’s required to have by law. Unfortunately, because licensing varies by industry and location and can occur on the federal, state, and local levels, there’s no central place to check to see if you have all the licenses and permits you need. You’ll need to do some research.

If you don’t feel like doing all this research, or if you just want the peace of mind of knowing that your business has every license and permit it’s legally required to have, our business license report service can do the work for you.

-

The fee for filing the NH Certificate of Formation online is $102, but this isn’t the only fee you might encounter.

-

Starting an LLC provides business owners with personal liability protection and flexibility. Because the business is its own legal identity, the owners’ personal assets are separate from the business and not usually available to satisfy business debts and liabilities. Further, the LLC allows the owners to customize their experience with operations, distributions, and taxes.

-

Federal Taxes

LLCs are typically considered “pass-through entities,” meaning that the business itself typically doesn’t pay federal income tax on its profits. The responsibility to pay income taxes falls only on the individual. This differs from most corporations, where profits are taxed at both the business level and the individual owners’ level.

Single-member LLCs don’t have to file a separate federal return for their LLC. They report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate information federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

Although LLCs are taxed as sole proprietorships or general partnerships by default, LLCs also have the option to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation, which can be advantageous for certain LLCs.

In particular, many LLCs elect to be taxed as S corporations because it can save the members money on self-employment taxes. You can learn more on our “What Is an S Corp?” page.

You also have a few other forms of federal taxation to keep in mind. For example, you’ll likely need to pay self-employment taxes on your share of the LLC’s profits. These are the taxes that go toward Social Security and Medicare. Fortunately, LLC members can deduct half of the self-employment taxes paid as a business expense.

State Taxes

If it meets the income threshold, a New Hampshire limited liability company will need to pay the Business Enterprise Tax and Business Profits Tax to the New Hampshire Department of Revenue Administration. For more information on what your LLC’s tax responsibilities will be, contact the New Hampshire Department of Revenue Administration and your local tax authorities.

-

When you submit your Certificate of Formation, the New Hampshire Secretary of State, Corporate Division will review the documents for compliance. If filing online, the review usually takes approximately five to seven business days. Filing by mail can take weeks.

-

No, the operating agreement is an internal document governing business operations and control.

-

By default, LLC owners only pay state and federal taxes on their personal income from the LLC. The LLC isn’t separately taxed.

Some LLCs (particularly those with high earnings) may choose to file taxes as either an S corporation or a C corporation. This option can have some advantages for certain LLCs. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages.

In evaluating these options, it’s helpful to get advice from a qualified tax professional.

-

No, New Hampshire doesn’t authorize Series LLCs.

-

When you need to close your business, you’ll follow the procedures in your operating agreement for dissolution and winding up. Usually, dissolution requires a member vote. You’ll need a Certificate of Dissolution from the Department of Revenue Administration showing that your LLC doesn’t owe any taxes. You’ll also need to let your creditors know of your closing by sending them a letter and publishing a notice in a local newspaper. Once you’ve paid your creditors and distributed any remaining assets to the members, you’ll file a Certificate of Cancellation with the Secretary of State to terminate your registration.

For more information, see our New Hampshire dissolution page.

-

A well-written operating agreement will detail the process for transferring your LLC ownership. Selling your interest usually requires the consent of the remaining members and a purchase agreement. You’ll also need to file an amendment to your Certificate of Formation to update the ownership.

For more information, see our New Hampshire LLC ownership transfer page.

-

Yes. Any business that operates under a name different from its registered name must file a DBA or trade name with the state.

-

Look to the provisions of your operating agreement for the process. You may have to take a vote or prove cause before removing a member. Your operating agreement likely also outlines the process for distributing the departing member’s interests to the remaining members. Don’t forget to update your Certificate of Formation with an amendment and ensure your operating agreement reflects the change in ownership.

-

Yes, New Hampshire LLCs must file an annual report updating the state on its information between January 1 and April 1 of each year.

-

While it’s not a legal requirement, it’s a good idea for a new LLC to have a business plan. Drafting a business plan can help you prepare for unexpected events and articulate your goals. Plus, investors and business partners will usually want to see your business plan.

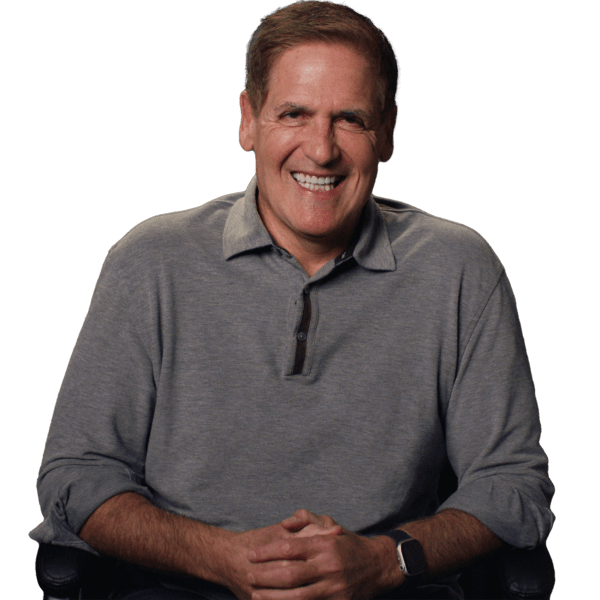

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

New Hampshire Business Resources

Start an LLC in Your State

When it comes to compliance, costs, and other factors, these are popular states for forming an LLC.

Ready to Start Your LLC?