How to Start an S-Corp in New Hampshire

One of the first choices you’ll make when starting a small business is to choose an entity type. If you’ve heard about the benefits of the New Hampshire S Corporation (S Corp), we wrote this page for you. The S Corporation isn’t a separate business structure. Instead, the S Corp is an election for “pass-through” federal tax treatment. Therefore, to form an S Corp, you must first register your business as a corporation or limited liability company (LLC). Then, you’ll elect S Corp status by filing Form 2553 with the IRS.

If you still have questions, we also have a general information page with more on forming an S Corporation. When you’ve made a decision, let us help you form your New Hampshire limited liability company (LLC) or New Hampshire corporation. When you start your business with us, our team of business experts will be here to help. We built our entire suite of business products and services with you in mind. For now, read on to learn about the S Corporation in New Hampshire.

1. Choose a name

The first step to starting your business is to choose a name. Your name must be unique from other New Hampshire businesses. When you’ve decided on a name, you can reserve it with the New Hampshire Secretary of State for 120 days. We offer a Business Reservation Service that can do this for you.

Register Your Business as an S Corp

Enter your desired business name to get started

2. Choose a statutory agent

Also known as a registered agent, your business will provide the agent’s address to receive legal notices from the state. You can choose a reliable individual or a company set up for this purpose.

3. Choose directors or managers

The corporation’s directors and the LLC’s managers run the business and make governing decisions. Limited liability companies can choose to have their members take this role, or can hire someone to take on the role.

4. File Articles of Incorporation or Certificate of Formation with the New Hampshire Secretary of State

Before you can legally do business in the state, you must file formation documents with the New Hampshire Secretary of State. Different business entities have different formation document requirements. Corporations will file Articles of Incorporation and LLCs will file a Certificate of Formation. Once you file and pay the accompanying fee, you will be legally authorized to start conducting business.

5. File Form 2553 to turn your business into an S Corporation

Once you’ve formed your business, the final step is to make the S Corp election. Corporations will file Form 2553, Election by a Small Business Corporation. LLCs must first elect to be taxed as a corporation, then they need to file Form 2553 to attain S Corp status.

S Corporation Requirements and Limitations

To meet the filing requirement for the S Corp election, you’ll complete Form 2553 and file it with the IRS. Before you can be eligible for the S election, your business must meet the following S Corp requirements:

- Be a domestic business (but not an ineligible company such as an insurance company, international sales corporation, or certain kinds of financial institutions)

- Have no more than 100 shareholders

- Have only allowable shareholders (individuals, certain trusts, and estates but not partnerships, corporations, or non-resident alien shareholders)

- Have only one class of stock

Your business must maintain these requirements to continue its S Corp status. To make the initial S Corp election, you’ll want to file Form 2553 within two months and 15 days after the beginning of the tax year or any time during the preceding tax year.

Pros and cons of creating an S Corporation

While the S Corporation provides many benefits, it may not be the right fit for everyone. You should consider the pros and cons of the S Corp before deciding on the election.

Pros

When you create an S Corporation, you’ll get asset protection with pass-through taxation and tax-favorable characterization of income. The S Corp also allows for the cash method of accounting.

Cons

An S Corp requires additional formation and maintenance expenses. Your business will be subject to tighter tax qualification obligations, stock ownership restrictions, and closer IRS scrutiny. You’ll also have less flexibility in allocating income and loss. Finally, because New Hampshire doesn’t recognize S Corp status, there’s no benefit for state taxes (such as state income tax).

What to know before creating an S Corporation in New Hampshire

First, you should know that the IRS has default taxation methods for each type of business. Second, New Hampshire doesn’t recognize federal S Corp elections, so you should consider the overall benefit of the S Corp election to your tax liability.

What is an S Corporation?

S Corporations are small business corporations with limited corporate shareholders. Those shareholders don’t pay federal corporate income taxes. Instead, the profits and losses are “passed-through” to the owners to pay at their individual tax rates.

What’s the difference between an S Corporation and a C Corporation?

The IRS’s default tax treatment for business corporations is the “C Corp.” C Corps are subject to double taxation, meaning that the corporation pays income taxes at the corporate level and withholds employment taxes from its employees’ wages. When you elect S Corp status, the profits and losses from the business are “passed through” to the business owners. The S Corp won’t pay corporate income tax. Instead, the owners will pay taxes on the business’s profits and losses on their personal income tax returns.

At the state level, New Hampshire taxes S Corps according to their underlying business structure regardless of their federal election. Therefore, S Corporation filing requirements are simple. If you formed your business as a corporation, New Hampshire will tax your business as a corporation. If you formed another entity type, the state will tax the S Corp as that entity type.

New Hampshire doesn’t have a general income tax, but it does charge taxes on dividend income. It also requires some businesses to pay a Business Profits Tax (BPT) and Business Enterprise Tax (BET). The entity type’s only difference is when calculating gross business profits (for BPT) or accumulated revenues and profits (BET). All businesses that exceed the tax thresholds will pay the tax regardless of the entity type.

What are the requirements to create an S Corporation?

To create an S Corporation, you have to form a business that falls within the limitations identified above, and you have to file Form 2553 with the Internal Revenue Service (IRS) within one of the timeframes listed above.

Can LLCs choose an S Corporation election?

Yes, LLCs can choose an S Corp election. By default, the IRS treats an LLC as either a sole proprietorship (one member) or a general partnership (multiple members). These entity types use “pass-through taxation.” Owners of “pass-through” entities pay income taxes on the business’s profits and losses at the individual rate. They’ll also pay self-employment tax on their income.

So if the LLC is taxed by default using “pass-through” taxation, what benefit can S Corp status make? When an LLC makes the S Corp election, the owners continue to report the business’s profits and losses on their individual returns. However, they will no longer pay the self-employment tax. Instead, the LLC will pay them a reasonable salary and withhold employment taxes on that salary. For more information on LLCs and tax treatment, visit our Tax Info for LLCs page.

We can help

When you’ve decided that the New Hampshire S Corporation is right for your new business, let us help. Our team of business experts can ensure you complete all the steps needed to form an S Corp. Then, we’ll guide you through legal compliance for the life of your business. Choose our products and services, and we’ll be here to answer all your questions.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in New Hampshire

Enter your desired name to get started

New Hampshire S Corp FAQs

-

-

When you create an S Corp in New Hampshire, the IRS will allow your business to use the “pass-through” method of taxation for its federal taxes. The business won’t pay corporate income taxes; you’ll report the business’s profits and losses on your individual return. You won’t need to pay the self-employment tax, but you will need to pay employment taxes on your salary.

-

-

-

You’ll name your S Corporation based on the underlying business structure. If you formed your business as a corporation, include the word “corporation,” “incorporated,” or “limited,” or an abbreviation for those terms. If you formed an LLC, include the words “limited liability company,” or “LLC,” in the name.

-

-

-

No. Because the S Corp election doesn’t change the underlying business structure, you should continue to identify your LLC as such. The LLC designation alerts consumers to the business owners’ limited liability.

-

-

An S Corporation will complete a Schedule K-1, which apportions its profits and losses to the shareholders (or members) according to their share of ownership. Based on this share, you’ll calculate your federal income taxes on your individual return.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

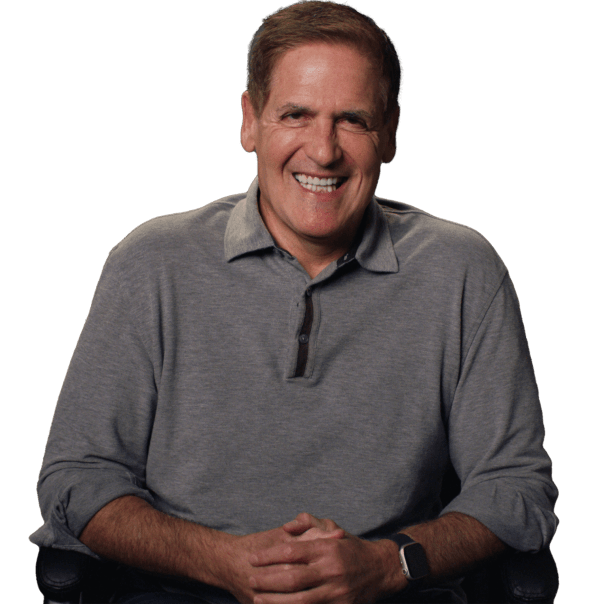

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

New Hampshire Business Resources

How to File an S Corp in Your State

Ready to Start Your New Hampshire S Corp?