How to Start an S-Corp in Mississippi

Starting a business can be both exciting and scary. Having a great idea is only the first step in building a company you can be proud of. We’re here to help with tools and services designed to help keep your business moving forward. Following the initial formation of your business, you will need to determine the tax structure that best fits your company’s needs.

Whether you are forming a Mississippi limited liability company (LLC) or a corporation, we can help. Choosing your tax structure for these business types is an important step to ensuring success. A Mississippi S Corp is a type of tax structure election that may help reduce your tax expenses. Learn more about S corporations and determine if an S Corp is right for your business.

Forming an S Corporation in Mississippi

The first step to forming your S Corp in MS is officially registering your business with the Mississippi Secretary of State. Limited liability companies and corporations are two common business structures that may choose to elect S-Corp status. Here are the steps for each structure:

1. Choose a Name for Your Business

Adhere to all Mississippi state naming requirements and limitations for your corporation or limited liability company. Your business name should make your purpose clear and be different from the name of any other business.

Register Your Business as an S Corp

Enter your desired business name to get started

2. Choose a Registered Agent

A Mississippi registered agent receives all business and legal correspondence for your company. They are required to be available during all business hours. We can help you find a Mississippi registered agent if you need one.

3. Decide on your Directors or Managers

Limited liability companies have managers and corporations have directors. These leadership designations are important for the formation process and must be listed on initial documents. Your corporate board of directors or LLC members and managers will be responsible for most major decisions regarding business operations. They can be changed later on as necessary.

4. File Articles of Incorporation or Certificate of Organization with the Mississippi Secretary of State

To officially form your corporation or LLC, you must first file Articles of Incorporation (for corporations) or a Certificate of Organization for LLCs. We can handle this step for you with our business formation services.

5. File Form 2553 to elect S Corp status

The final filing requirement for your tax status is to notify the Internal Revenue Service (IRS) of your decision to become a Mississippi S Corp. Once your business has received its EIN, you will file a Form 2553 with the IRS to elect S Corp status. LLCs must file Form 8832 before filing for S Corp status.

Mississippi S Corporation Requirements

Though the S Corporation election is the best option for many companies, it is not meant for everyone. Here are the requirements:

- Your business must be a domestic corporation or LLC

- The business may only issue one class of stock, meaning that all members must have the same distribution amount

- The corporation can have no more than 100 shareholders

- All shareholders must be private individuals (not other business entities)

- Nonresident aliens cannot be shareholders

- Ineligible corporations include certain financial institutions, insurance companies, and domestic international sales corporations.

If you are not sure whether your business qualifies for S Corp election, consider seeking advice from a tax or finance professional.

Pros and Cons of Mississippi S Corp Election

Choosing a tax structure for your company is highly dependent on your business’s unique circumstances. Here are some factors to consider.

Pros of S Corp election

Owners of S Corps are considered employees of their company. This designation has the potential to save thousands of dollars on self-employment taxes as a result. S Corps are pass-through taxation entities, which is the most prevalent benefit of electing to file as an S Corporation. Self-employed business owners may opt for classifying some of their income tax as distribution and some as salary, resulting in tax savings.

Cons of S Corp election

MS businesses that have elected S Corporation status must adhere to other obligations of the business structure, which is more formal than that of a C Corp. An S Corporation can have no more than 100 shareholders and only one class of stock. S Corps are often subject to increased IRS scrutiny because of the options for payment classification. A Mississippi S Corp still has to pay corporate franchise taxes.

What to know before creating an S Corporation in Mississippi

There are a couple of things to keep in mind before creating a Mississippi S Corp including requirements and limitations. If you don’t do anything else after forming your business entity and receiving your EIN, your business will automatically default to a C Corp. You have to file Form 2553 to change that.

File the form not more than 2 months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the tax year preceding the tax year it is to take effect. There are exceptions to specific circumstances that may have prevented you from making a timely election.

What is an S Corporation?

Defined by Subchapter S of the IRS tax code, an S corporation is a tax designation that is chosen by an LLC or corporation. It is important because it governs how the business is taxed.

What’s the difference between an S Corporation and a C Corporation?

An S Corporation is a business entity that has elected to pass its corporate income, losses, credits, and deductions to its shareholders or members to include on their personal income taxes. These “pass-through” entities are not taxed at the corporate level. A Mississippi S Corp does have to pay corporate franchise taxes.

C Corporations are separately taxable entities. Income is taxed at the corporate level and again on the individual tax returns of members or shareholders. This is called double taxation.

Can LLCs choose an S Corporation election?

Both LLCs and corporations can elect Mississippi S Corp status. Here are some of the benefits and downfalls of taxation as an S Corp for LLC tax purposes and corporations.

We can help

If you are in the process of forming your business, you should strongly consider your tax designation and what is best for you. We can help you start your LLC and provide S Corp formation services at the same time.

There are many steps on the road to a successful business, and it is easy to miss some of them. We have the tools and services you need to stay on track, from formations to compliance and business maintenance. You have enough to think about already, so let us help lighten your load.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in Mississippi

Enter your desired name to get started

Mississippi S Corp FAQs

-

S Corps are pass-through taxation entities, which is the most prevalent benefit of electing to file as an S Corporation. This designation has the potential to save thousands of dollars on self-employment taxes.

-

Choose a name for your Mississippi S Corp according to state guidelines for your business type.

-

You do not need to identify your LLC as an S Corporation. You just need to file the proper paperwork with the IRS.

-

S Corporation taxes are passed through to the personal income taxes of members or shareholders. Mississippi S Corporations are responsible for paying corporate franchise taxes at the business level.

-

When an LLC or C corp elects to be taxed as an S corporation for federal income taxes, Mississippi, like most states, applies state income tax in the same way. That is, the business itself doesn’t pay federal or state income tax on the profits. The profits are usually taxed only on the personal income tax return of the individual owner or owners. However, all S corporations in Mississippi are subject to the state’s franchise tax, which is taxed and paid at the entity level.

-

Yes, and S corporations in Mississippi must pay the franchise tax at the entity level.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

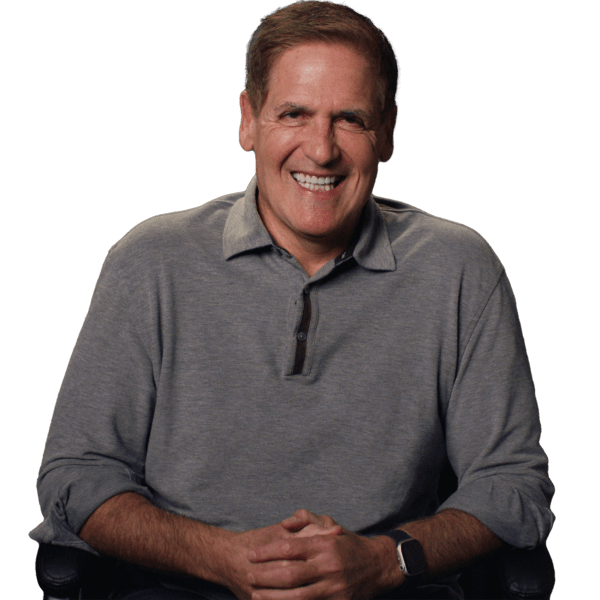

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

Mississippi Business Resources

How to File an S Corp in Your State

Ready to Start Your Mississippi S Corp?