How to Start an S-Corp in Utah

Are you considering filing for an S Corporation in Utah? If you have a business idea that you’re ready to execute, an important decision to make is what kind of company structure you want. A popular business structure is the S Corporation.

A Utah S Corporation isn’t a formal business entity, rather, it’s an IRS-approved tax election that could provide you with multiple benefits. Before you make the leap into S Corp ownership, let’s go over how to set up an S Corp in Utah and why you might want to do it. You can also learn more about S Corporations on our Information page.

An S Corporation often starts as a limited liability company (LLC) or business corporation. If you’re clueless about starting LLCs, or if you don’t know how to form a corporation in Utah, you’ve come to the right place. We can help you check off this first to-do quickly with our Utah LLC Formation Service or our Utah Corporation Formation Service.

And as you run full speed ahead with your new business venture, we can help keep your business operations running smoothly with our vast catalog of business development and maintenance services.

How to create an S Corporation in Utah

As we said above, S Corporations often start as LLCs or business corporations, and then their owners elect to run S Corps by filing additional paperwork. These are basic steps for starting a business that can become a Utah S Corporation (such as naming your business, appointing a registered agent, and filing formation documents with the state):

Step 1: Choose a name

Fortunately, you have a lot of options when choosing your business name, because there are only a handful of rules you have to follow when naming your business. In general, your Utah corporation or Utah LLC name needs to:

- Contain appropriate words or abbreviations to identify what kind of business you started

- Not contain certain unauthorized words

- Not contain words that suggest your business has an impermissible purpose (for corporations)

- Be distinguishable from other names on record with the state

If you follow additional steps, sometimes you can select a name that isn’t distinguishable from others on record with the state.

Register Your Business as an S Corp

Enter your desired business name to get started

Step 2: Appoint a Registered Agent

A registered agent is required by Utah state law. Your registered agent receives legal documents and official correspondence such as service of process on behalf of your business.

Step 3: Select a Board of Directors (for a corporation) or Members (for an LLC)

A Board of Directors is responsible for handling and managing the affairs of a corporation. Each director of your corporation must be a natural person. A Utah limited liability company requires that at least one person becomes a member.

Step 4: Submit Articles of Incorporation or a Certificate of Organization to the Utah Division of Commerce

Articles of Incorporation and Certificates of Organization are the main business-forming documents for corporations and LLCs, respectively. When you file one of these documents with the Utah Division of Commerce, you normally need to pay an accompanying filing fee.

Step 5: File Form 2553 to turn your Utah business into an S Corporation

To give your business S Corp tax status, you complete Form 2553 with the Internal Revenue Service (IRS). If you start your business as a Utah LLC, you have to complete Form 8832 to elect corporation status before you can begin filing Form 2553 to elect S Corp status.

Now, let’s review what running an S Corporation generally involves.

S Corporation requirements and limitations

Not every business can become an S Corporation. If you want your business to be an S Corp, it must normally do the following:

- Be a domestic entity

- Not exceed 100 shareholders

- Have only one class of stock

- Have only permissible shareholders, such as estates, individuals, and certain trusts, but not partnerships, non-resident immigrants, or corporations

- Not be an ineligible corporation, including insurance companies, domestic international sales corporations, or certain financial institutions

Depending on the kind of business you want to run, this list of requirements might be too prohibitive, or it might be insignificant. It’s best to speak to tax or financial professionals (such as payroll and accounting services) about your needs and options.

Pros and cons of creating an S Corporation

Business decisions usually come with positive and negative attributes. Deciding whether to start an S Corporation is typically no different in this regard. Below, let’s go over some of the positives and negatives of starting an S Corp.

Pros

Typical benefits of an S Corp can include:

- The option for cash method accounting

- Asset protection

- Pass-through taxation

- The option to characterize income in a more favorable way

For your business’s unique needs, these benefits might far outweigh any disadvantages of running an S Corporation. Financial and legal services professionals can help you make a sound determination about whether an S Corp is right for you.

Cons

Disadvantages of running an S Corporation can include:

- Additional formation and maintenance requirements

- More involvement from the IRS

- Strict eligibility requirements and limitations

- Stock ownership restrictions

Depending on the kind of business you want to run, there could be more disadvantages. It’s best to discuss your options with legal experts and tax professionals before making a decision.

What to know before creating an S Corporation in Utah

What is an S Corporation?

Although an S Corporation sounds like a distinct business type, it isn’t. An S Corp is a tax designation you choose for a business you’ve already formed. Giving your business S Corp status can give your business tax perks it might not normally have.

What’s the difference between an S Corporation and C Corporation?

Two of the biggest differences many people recognize between S Corporations and C Corporations are the limitations that S Corporations have and the heftier tax liabilities C Corps often have.

Unlike S Corporations, C Corporations can normally issue more stocks to more kinds of shareholders. Owners of C Corps also have more options for the kinds of businesses they want to run. These differences can be significant, but one of the most significant differences for many is the way each kind of business pays taxes.

C Corporations typically have the burden of double taxation. This means that a C Corporation pays income taxes at the corporate level, and then corporation shareholders pay personal income tax on their distributions from the corporate income.

S Corporations normally have the benefit of pass-through taxation. With pass-through taxation, the S Corp itself doesn’t pay taxes, just the shareholders pay personal income taxes and self employment tax on their distributions from the business’s income.

What are the requirements to create an S Corporation?

Before a business can become an S Corporation, it has to operate within the limitations we listed above and file the proper paperwork. The main part of your Utah S Corporation filing requirements is submitting Form 2553 to the Internal Revenue Service. To properly submit the form, your business needs to have an Employer Identification Number (EIN).

We can help you get your EIN in no time with our Employer ID Number Service.

Can LLCs choose an S Corporation election?

Yes, an LLC can choose S Corporation status. Each LLC owner is different, but many make the S Corp election for tax benefits, such as more favorable employment taxes. Taxes might play a big role in whether you choose to make your LLC an S Corp. You can read more about LLC tax liabilities on our Tax Information for Limited Liability Companies page.

We can help

You can often achieve the most in business when you have good support. Our purpose is to offer that support. If you want to start an S Corporation, we can help you do it quickly with our S Corporation Service. Our many services are here to help you with your business formation, maintenance, and compliance needs.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in Utah

Enter your desired name to get started

Utah S Corp FAQs

-

There are many benefits to creating an S Corporation, including the ability to run a business that limits your personal liabilities while maintaining lighter tax obligations.

-

Your business’s name must include wording or abbreviations that identify what kind of entity it is under Utah law.

It can’t include words that suggest the business is affiliated with certain organizations, and it has to be distinguishable from other names on record with the state.

Otherwise, choosing a name for your S Corporation boils down to what you believe is best.

-

You identify your LLC as an S Corporation by filing the proper paperwork with the IRS.

-

How you calculate your S Corporation’s taxes depends on the unique attributes of your business. It’s best to speak to a tax professional about your specific options and obligations.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

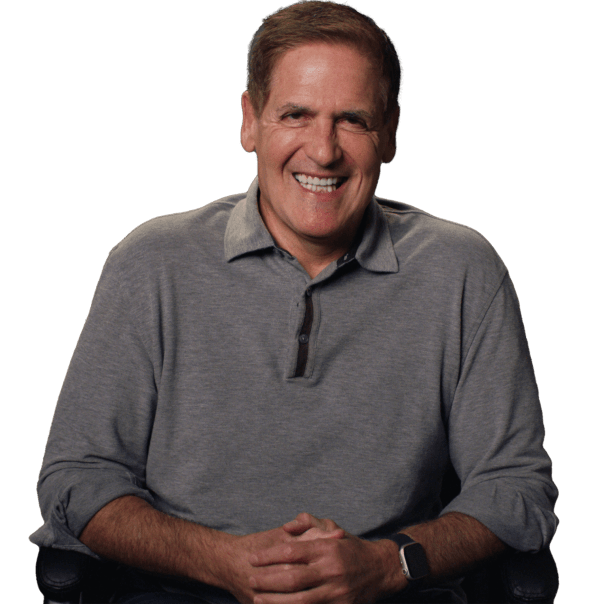

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

Utah Business Resources

How to File an S Corp in Your State

Ready to Start Your Utah S Corp?