Start an S Corp in Georgia

S corporations (S Corps) in Georgia are a tax filing option that you can take when start your business. They offer the benefit of reducing tax liabilities through pass-through tax treatment. Pass through taxation is a special status recognized by IRS.

When companies choose this status, they don’t pay corporate income taxes. Instead, business profits are passed through on the owners according to the ownership percentages and are reported on their personal tax returns. However, in order to take advantage of this highly versatile business vehicle, you first need to know fundamentally what an S corporation is. We’ll explain what it is and how to file for an S corp in Georgia.

If you’re just starting your LLC or corporation, we can help you form your business and file as an S corp for you. Get started by clicking the button above, or learn more about starting an S corp in Georgia below.

Setting up an S Corporation in Georgia

To begin, an S Corporation is not a stand-alone entity like a C corporation (C Corp) or limited liability company (LLC). Rather, it is a federal tax election under the IRS, which confers the above-mentioned pass-through tax treatment on its shareholders.

1. Choose a Business Name

When considering a name for your business, make sure to select one that will stand the test of time.

We offer services to help make choosing a name easier. We can search to ensure that your desired name is not already registered with the Corporations Division of the Georgia Secretary of State, and we can help guide you to adhere to other naming requirements for Georgia corporations and LLCs.

You can also use our domain name checker tool to see available website options for starting your business.

Register Your Business as an S Corp

Enter your desired business name to get started

2. Appoint a Registered Agent in Georgia

The Georgia Secretary of State (SOS) requires all business entities to have a registered agent available during normal business hours to accept service of process and other important documents.

While you can serve as your own registered agent, it’s common to appoint someone else or use a service. This allows you to be away from your office and not have to worry about being available for important legal documents (should any be presented to you). We offer a reliable registered agent service in Georgia that will not only comply with this requirement but take it off your list of things to do.

3. Choose directors or managers

You will need to appoint initial directors (C Corp) or managers (LLC) for your business. The easiest way is through an initial company resolution. Note that initial company resolutions can come from the company’s founders.

4. File Articles of Incorporation/Organization

At this point, you are ready to make your foundational business entity. To do so, file Georgia Articles of Incorporation for your C Corp or Articles of Organization for your LLC with the SOS and pay all state filing fees.

Georgia corporations may also need to start a corporate records book and create corporate bylaws. You also need to file for an employer identification number (EIN) as well, but we can help with that.

5. File Form 2553 to apply for S Corp status

This is where you actually create your Georgia S Corp by filing Form 2553 with the Internal Revenue Service (IRS). It is truly IRS Form 2553 that turns your C Corp or LLC into a Georgia S Corporation.

Keep in mind that if you’re using an LLC, you first need to make a tax election with the IRS and possibly the Georgia Department of Revenue to treat it as a corporation.

S Corporation Requirements and Limitations

To receive the significant S Corp tax benefits from the IRS, you must fulfill specific requirements in forming a Georgia S Corporation. The IRS states that an S Corp must:

- Be a domestic corporation or other eligible business

- Have only certain kinds of corporate shareholders, including individuals, estates, exempt organizations, and certain trusts, but not partnerships, corporations, or non-resident immigrants

- Have no more than 100 shareholders

- Have no more than one class of stock

- Not be an ineligible corporation such as an insurance company, international sales corporation, or a certain kind of financial institution

Given the above restrictions on shareholders, a Georgia S Corp might not be right if you think you may need to attract more capital in the future from existing or new shareholders.

Therefore, discuss your financing plans with your legal and financial professionals to confirm what’s the best business entity for you.

Pros and cons of Georgia S Corporations

S Corps are unusual animals. Because of that, we thought it would be helpful to set out some pros and cons for you to weigh before settling on a Georgia S Corporation.

Pros

Running an S Corporation can be beneficial for Georgia business owners in many ways, such as:

- Protecting your personal assets

- Eliminating corporate double taxation

- Allowing you to use the cash method of accounting

Clearly, the above benefits make an S Corp very attractive, especially if you are trying to reduce your tax footprint.

Cons

Of course, there can also be drawbacks to Georgia S Corporations, such as:

- Additional expenses for formation and maintenance

- Restrictions on issuing shares (only one class of stock is permitted)

- More extensive IRS oversight

- More stringent eligibility requirements

We hope that the above will stimulate further thoughts about how an S Corp may or may not fit into your overall business ideas.

What to know before creating an S Corporation in Georgia

As mentioned above, Georgia S Corporations are not stand-alone business structures but rather special tax status elections made by LLCs and corporations. Below we offer a few more insights about S Corporations for your consideration.

What is an S Corporation?

An S Corporation is a special tax status defined in Subchapter S of the Internal Revenue Code. Election of the status by a small business offers certain tax advantages compared to the taxation of large companies.

The main advantage is that by electing an S corp status an LLC or corporation avoids the issue of double taxation of its business profits. In S corporations, profits get passed onto their shareholders and the shareholders pay their income tax individually.

What’s the difference between an S Corporation and a C Corporation?

First, while S Corps have IRS restrictions on the amounts and classes of shares that it issues, as well as who can be a shareholder, C Corps have virtually none.

However, the most significant difference and possibly the biggest draw, is how an S Corp’s income is treated for tax purposes.

You probably have heard of the classic C Corporation’s double tax on income (i.e., the C Corp pays income taxes at the corporate level, and then each shareholder has to pay taxes on their income from the corporation). S Corporations are free of this double tax because they pass their income to the shareholders so only the shareholders have to pay taxes on the Georgia S Corp’s income.

What are the requirements to create an S Corporation?

To set up a Georgia S Corporation, you first have to create a foundational entity such as a C Corp or LLC. Then you must file Form 2553 with the IRS. That said, make sure you follow the IRS guidelines before you file Form 2553.

Can LLCs choose an S Corporation election?

Yes. There’s no reason an S Corp can’t have an LLC as its foundational entity. Further, choosing to tax your LLC as an S Corporation may reduce some of your tax liabilities and thus add even more benefit to the already flexible nature of an LLC.

Learn more about LLCs and taxation on our Tax Information for Limited Liability Companies page.

How We Can Help

Since an S Corp is simply a tax election, the true beginning point to creating a Georgia S Corp is by starting the initial business. We can simplify that part with our Georgia LLC Formation Service and our Georgia Corporation Formation Service. Once your business is established, we offer continuing support with our various business development and maintenance services.

We can untangle all of the seemingly complex aspects of an S Corp for you. Therefore, if you want to start a Georgia S Corp, then our S Corporation Service can do it quickly and accurately. You can also look to us to assist you with the formation, maintenance, or compliance needs of your enterprise. We are here to help.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in Georgia

Enter your desired name to get started

Georgia S Corporation FAQs

-

Creating a Georgia S corporation allows for the limited liability of a C Corp while also providing the benefit of pass-through taxation.

-

Generally, a corporate name needs to be professional and something you can live with for the life of the business. It must also follow state rules regarding naming businesses.

-

There is no need to identify your LLC as a Georgia S Corp. Provided that you’re following the Georgia naming restrictions regarding the use of “LLC” or “limited liability company,” you don’t need to go any farther than that.

-

Generally, your taxes are calculated at your personal income tax level. Review the specific requirements with both the IRS and the Georgia Department of Revenue to make sure you comply. We encourage you to consult your tax professional since tax filing is highly specialized.

Disclaimer: The content on this page is for information purposes only, and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

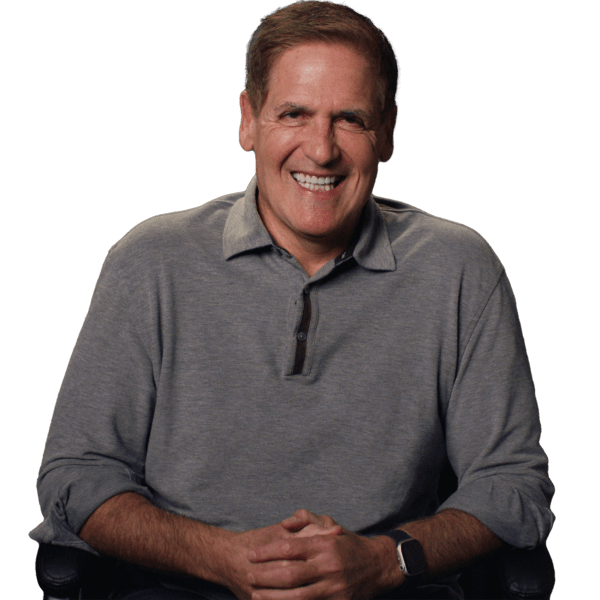

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

Georgia Business Resources

How to File an S Corp in Your State

Ready to Start Your Georgia S Corp?