How to Start an S-Corp in New Mexico

Interested in setting up an S Corp in New Mexico, yet you’re unsure what it means or where to start? You’ve come to the right place. Although not a formal type of business structure like an LLC or C Corporation, S Corporations are a tax election you make with the IRS. If approved, the IRS allows you to pass all business income, losses, deductions, and credits to the shareholders who pay the income tax at their personal rate.

We’ll walk you through each step in how to form a New Mexico S Corporation. Since you need an underlying entity to make an S Corporation election, it’s important for you to understand how to first set up a corporation or LLC. With our New Mexico Corporation Formation Service and New Mexico LLC Formation Service, we take care of the formation process for you.

After creating your business, we’ll be there to support you with all the different products and services we offer for small businesses. Whether you want to write a business plan or need help keeping up with compliance obligations, we’ve got you covered.

1. Choose a Name

Carefully select a name that reflects your business and complies with state law. For example, New Mexico requires that businesses include certain words in their name.

If you need help searching for a business name or reserving one, we can do that for you.

Register Your Business as an S Corp

Enter your desired business name to get started

2. Choose a Registered Agent

You must appoint a registered agent to receive important paperwork for your business. This can be an individual or entity.

3. Choose Directors or Managers

Directors (for corporations) and managers (for LLCs) are responsible for keeping the business running day to day. It’s important to select directors or managers you trust and who are capable of handling the business operations. LLCs can choose a member to serve in this role or hire someone from outside the LLC to do so.

4. File Formation Documents with the New Mexico Secretary of State

When you’re ready to form your corporation or LLC you must file the formation documents. Depending on the business structure, you will file either Articles of Incorporation for corporations or Articles of Organization for LLCs. Once accepted by the Secretary of State, your business is official!

Your corporation or LLC will need an Employer Identification Number (EIN) to do things like file taxes, open a bank account, get financing, and hire employees. You’ll need this number to file an S Corporation election. Let us get your business EIN for you with our EIN Service.

5. File Form 2553 to apply for S Corp status

To make the S Corporation election, you need to file Form 2553 with the IRS. If you have an LLC, it’s important that you change the tax election to a corporation first and then make an S Corporation election.

S Corporation Requirements and Limitations

Creating an S Corporation isn’t as simple as merely filing for the election. Your business must also meet the IRS’s following requirements:

- Be formed in the United States

- Have no more than 100 shareholders

- Have no more than one class of stock

- Not be an ineligible corporation (e.g., insurance company, certain financial institutions, or international sales corporation)

- Have only allowable shareholders

All shareholders must unanimously consent to the S Corporation election. If you’re still not sure whether a New Mexico S Corporation is right for you, it’s a good idea to speak to legal and financial professionals about your best business options.

The timeframe to file Form 2553 is either:

- Within the first two and half months of the year that you form the underlying entity if the election is to be effective in the first tax year, or

- Any time during the tax year before you want the S Corporation status to take effect.

You can’t file for S Corp status before forming your corporation.

Pros and Cons of Creating an S Corp in New Mexico

S Corporations don’t work for every business, so it’s important to look at both the pros and cons. A legal or tax professional can also help you decide if a New Mexico S Corp is beneficial for your business.

Pros

There are many benefits of an S Corp, including:

- Asset protection

- Elimination of double taxation

- Use of the cash method of accounting

What makes S Corporations so attractive is the tax savings they provide. S Corporations pass income, losses, credits, and deductions through to the shareholders, so income tax is paid on the individual level, which is typically lower than the corporate rate. The other tax benefit is the flexibility for S Corporations to qualify distributions as either dividends or salaries. Dividends are not subject to self-employment tax, like salaries. The result of this is a lower tax bill at the end of the year.

Cons

S Corporations have their disadvantages too. Consider the following:

- Can be expensive and time-consuming to form and maintain

- Not all businesses will meet the IRS’s requirements

- Lack of flexibility with profit and loss sharing

- Closely scrutinized by the IRS

Our list of pros and cons is not exhaustive. We recommend that you talk to a professional about whether an S Corporation will align with your business needs and goals.

What to know before creating an S Corporation in New Mexico

As discussed above, you need to create a business entity before filing for an S Corporation election. When you form a corporation, the entity is a C Corporation by default and is taxed as such. To benefit from the tax treatment of an S Corporation, you have to go through the New Mexico S Corporation filing requirements.

What is an S Corporation?

S Corporations are small business entities that elect to pass their corporate income, losses, credits, and deductions to their shareholders, avoiding corporate double taxation.

What’s the difference between an S Corporation and a C Corporation?

The main difference between S Corporations and C Corporations is their tax treatment. C Corporations are taxable entities that pay double income taxes, and S Corporations don’t. The way it works is when a C Corporation generates income, it pays corporate income tax, and then when the shareholders receive distributions, they also pay income tax on their dividends. S Corporations avoid the corporate tax altogether and pass their income directly to the shareholders, who report the income on their individual returns.

What are the requirements to create an S Corporation?

To form an S corporation, you must create an entity that satisfies the IRS’s requirements listed above, and then timely file Form 2553 with the IRS.

Can LLCs choose an S Corporation election?

Absolutely! LLCs can file for an S Corporation election to take advantage of all the tax benefits.

Visit our page on Tax Information for Limited Liability Companies to learn more!

We can help

If you think your business can benefit from electing S Corporation status, then let’s get started! With our S Corporation Service, we can help you get the job done quickly. If you’re in the beginning stages where you still need to form a corporation, our experts are happy to assist.

As you continue on your journey as a business owner, know that we’re here with the tools, products, services, and resources you need. Our goal is to help entrepreneurs create, run, and grow their dream business.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in New Mexico

Enter your desired name to get started

New Mexico S Corp FAQs

-

S Corporations offer significant tax benefits and allow business owners to take advantage of:

- Pass-through taxation

- Self-employment tax deduction

- Qualified Business Income (QBI) deduction

- Use of the cash method of accounting

A New Mexico S Corp also protects the shareholder’s personal assets from being used to satisfy business liabilities.

-

An S Corporation’s name should reflect the products or services of the business, but more importantly, meet the state’s requirements.

-

Choosing an S Corporation election for your LLC depends entirely on your business’s situation. Keep in mind, not all LLCs can qualify as an S Corporation. It may be best to speak with a legal and/or tax professional to help you make this decision for your business.

-

S Corporations pass all income, losses, deductions, and credits through to the shareholders to report on their individual income tax returns. Although New Mexico S Corporations avoid federal corporate income tax, they’re still subject to the state’s corporate franchise tax.

Read our article on how to Calculate Your S Corporation Taxes and consider hiring a tax professional to help you calculate correctly.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

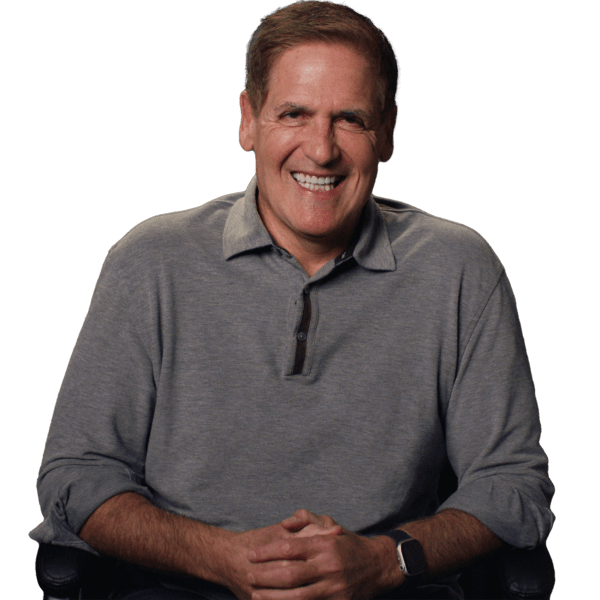

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

New Mexico Business Resources

How to File an S Corp in Your State

Ready to Start Your New Mexico S Corp?