How to Start an S-Corp in Alabama

If you want to learn more about S Corporations (S Corps) in Alabama, then you’re in the right place. Our detailed guide below can help shed some light on the process of starting an S Corp in Alabama along with some additional information about this designation.

Limited liability companies (LLCs) can enjoy some benefits if they file as an S Corp, like saving on self-employment taxes. For corporations (C Corps), you can avoid double taxation.

What is an S Corp?

An S Corp is a great option for Alabama business owners who want a way to help raise capital and reduce their tax liabilities. An S Corp is not a formal business structure. Unlike a C Corp or LLC, an S Corp is a type of Internal Revenue Service tax classification.

To get S Corp status in Alabama, you must first form a C Corp or LLC. Then, you’ll file for your Employer Identification Number (EIN) with the IRS and file for S Corp status. Filing for S Corp status lets your business pass its tax liability on to the corporation shareholders, who file on their personal income tax returns. Learn more about whether filing as an S Corp could help your business by reading through our “What is an S Corporation?” page.

Filing as an S Corp in Alabama

Starting your own business is an exciting venture, but it can also be stressful and time-consuming. Before you call up an expensive attorney or law firm to help you get S Corp tax status, read on. We’ve made it our mission to help business owners just like you throughout the business life cycle.

1. Choose a Business Name

Once you’ve taken the preliminary steps of creating a business plan and selecting an entity structure for your business, the next step in creating your Alabama S corp is to choose a name. Be sure to check the state’s business records to verify that the name you want isn’t already being used by another Alabama business.

Reserve your business name

If you have an available name in mind, but you haven’t filed for your Alabama Certificate of Incorporation, then you’ll want to file for a name reservation certificate. We can help you reserve your business name to ensure that nobody takes it while you complete the business formation process.

Register Your Business as an S Corp

Enter your desired business name to get started

2. Appoint a Registered Agent in Alabama

Next, you’ll need to choose an Alabama registered agent for the business. A registered agent is a must, and lacking one can result in your business losing its “good standing” status with the state.

What is a registered agent?

A registered agent serves as the official recipient for any service of process and other important legal notices on your business’s behalf. This agent can be either a person or another business and must be available during normal business hours. You’ll name your registered agent during your business’s formation.

3. File formation paperwork with the Alabama Secretary of State

Finally, it’s time to register your business with the state. You will do so by filing a Certificate of Incorporation for corporations or a Certificate of Formation for LLCs with the Alabama Secretary of State. These documents formally create your legal business entity.

Before moving forward with the next step, you’ll also want to obtain an Employer Identification Number (EIN) for your business. We can help you do that with our EIN Service.

4. Create an operating agreement

Create an LLC operating agreement. Operating agreements outline the rules and procedures for the management of the LLC as well as establish ownership percentages, how profits are divided among members, and much more.

Your Alabama operating agreement also makes your business appear more legitimate to banks, investors, potential business partners, and the courts. While the state doesn’t legally require you to file an operating agreement, if you don’t have one, your LLC will be governed by default by Alabama’s LLC laws, which might not reflect your wishes.

Once an operating agreement is signed by all the members, it becomes legally binding. You don’t need to file it with any government agency, but keep it with your other important legal business documents so you can refer to it easily.

What should be included?

Typical concepts in an LLC operating agreement may include:

- Procedures for admitting or removing LLC members

- Allocation of profits and ownership

- Management structure and voting requirements

- Procedures for dissolving the LLC and dividing its assets

Unsure as to how to create an operating agreement for your LLC? We offer a guided customizable template to help get you started. Our chatbot walks you through the process of creating your agreement and allows for e-signature of the document through HelloSign.

5. Apply for an EIN

Apply for a federal employer identification number. Unless you’re a single-member LLC without employees (and sometimes even then), you’ll likely need to get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). Even if you don’t legally need an EIN, getting one can help you open a business bank account or obtain credit to grow your business.

You can get your LLC’s EIN through the IRS website, by mail, or by fax. If you don’t want to deal with that particular government agency, we can get it for you. Our EIN service eliminates the hassle.

6. File Form 2553 to Turn Business into an S Corporation

Once you have a legally recognized business entity, you’re ready to turn it into an S Corp.

Regardless of whether you’ve decided to set up your business as a corporation or an LLC, to turn it into an S Corp, you’ll need to file a Form 2553 with the IRS. This is what formally allows you to request a status change to an S Corp.

For LLCs, however, before filing your Form 2553, you’ll first need to change your entity classification to S corporation tax status by filing IRS a Form 8832.

What to know before creating an S Corp in Alabama

Importantly, the default classification for entities upon formation is a C Corp. Thus, unless and until you file your Form 2553, your entity will be treated as a C Corporation. However, there are a few key considerations to note before choosing S Corporation tax status.

Requirements and limitations of S Corporations

Not all entities can choose an S Corp election. To qualify for S Corp classification, an entity must:

- Be a domestic corporation

- Have only allowable shareholders, which include individuals, certain trusts, and estates

- Have no more than 100 shareholders

- Not be an ineligible corporation, such as certain financial institutions, insurance companies, and domestic international sales corporations

- Have only one class of stock

If your business entity meets these filing requirements, you may choose the S Corporation tax status.

File Form 2553 with the IRS

It’s also important to know when to select S Corporation tax status. Specifically, you will need to complete and file your Form 2553 with the IRS:

- No more than 2 months and 15 days after the beginning of the tax year in which the election is to take effect

Or

- At any time during the tax year preceding the tax year the election is to take effect

For more information on when and how to file your Form 2553, visit the IRS’s website.

What’s the difference between an S Corporation and a C Corporation?

There are a few key differences between S Corporations and C Corporations.

Whereas S Corps benefit from pass-through taxation, C Corps don’t. Rather, C Corps must file and pay income taxes at the corporate level, and their shareholders must also pay taxes on those same profits on their own individual income taxes.

However, the pass-through taxation benefit of S Corps comes at a cost. Due to the number of requirements to qualify for an S Corp election, C Corps offer more flexibility in options and structure.

What are the requirements to create an S Corporation?

In short, to create an S Corporation, you must first have a business that complies with the requirements and limitations identified above. If your business qualifies for S Corp classification, you must then file Form 2553 with the IRS within one of the timeframes listed above.

Can LLCs choose an S Corporation election?

Contrary to what the name might imply, your entity doesn’t have to be a corporation to qualify for S Corp classification. LLCs can also make an S Corp election. And in fact, many choose to do so for a variety of beneficial tax purposes.

Weighing the pros and cons of creating an S Corporation

As with all things in life, there are a number of competing pros and cons of choosing to create an S Corporation. Some pros include:

- Asset protection

- Pass-through taxation

- Tax-favorable characterization of income

- Ability to utilize cash method of accounting

However, there are certain disadvantages to be aware of as well. Common cons of forming an S Corporation include:

- Higher formation and maintenance expenses

- Tighter tax qualification obligations

- Stock ownership restrictions

- Closer IRS scrutiny

- Less flexibility in allocating income and losses

S Corp election may not be right for all businesses. Ultimately, the decision of whether to elect S Corp classification will depend on the needs and goals of your particular entity.

We can help

Ready to take the next steps toward forming your Alabama S Corp? From business formation to compliance and maintenance, we’re standing by and ready to help support you at every step along the way. Start your company and file an S Corp with us today.

We can also help get your business off the ground with our Alabama Corporate Formation Service and LLC Formation Service.

No matter what type of business you operate, check out our many products and services and find out what we can do to help you start, manage, and grow your business today.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in Alabama

Enter your desired name to get started

Alabama S Corp FAQs

-

Yes. All business entities registered under Alabama laws or doing business in the state are required to file a business privilege tax return. For S corporations, the amount of tax due is determined as the total amount of passed-through income multiplied by the rate apportioned for a specific income tier. For more information on Alabama business taxes including tax due dates, refer to this page.

-

There are many benefits of creating an S Corporation in Alabama. However, one of the most sought-after benefits of an S Corp is pass-through taxation.

-

Choosing a name for your Alabama S Corporation is one of the most exciting steps in the business formation process. Nevertheless, it’s important that you make sure to comply with any state naming formalities. Additionally, search the Alabama business entity records to ensure that you don’t choose a name that is the same or similar to one that’s already in use.

-

Choosing a name for your Alabama S Corporation is one of the most exciting steps in the business formation process. Nevertheless, it’s important that you make sure to comply with any state naming formalities. Additionally, search the Alabama business entity records to ensure that you don’t choose a name that is the same or similar to one that’s already in use.

-

Calculating taxes can be complex and confusing. Check out our S Corp tax guide or contact a certified tax professional for more information on how to calculate your S Corporation taxes.

-

Because no two business entities are the same, there is no easy answer to this question. Thus, if you’re not sure whether to identify your LLC as an S Corp, consult with a business law attorney in your state.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

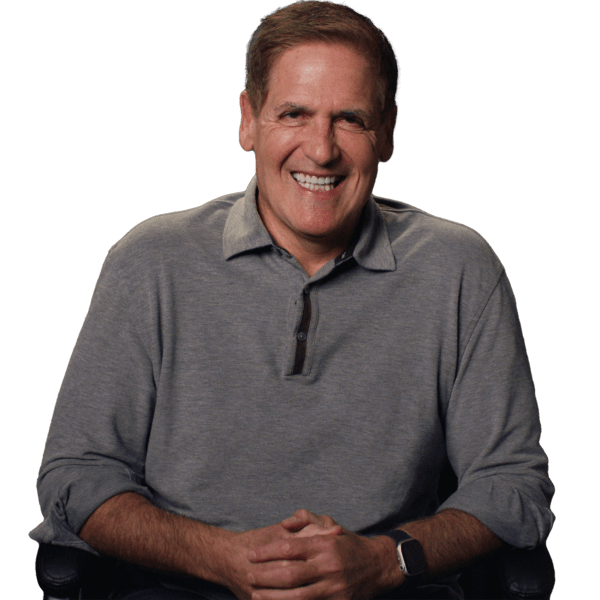

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

Alabama Business Resources

How to File an S Corp in Your State

Ready to Start Your Alabama S Corp?