How to Start an S-Corp in Montana

There are so many decisions to make when you’re starting a new business. One important decision to think about is what type of tax structure to choose. An S Corp in Big Sky Country is certainly something to consider.

S Corporations are often confused with formal entity structures like a corporation or limited liability company (LLC). But an S Corp is a federal tax election that could help you save on your taxes. You can find lots of helpful information about how S Corporations work on our S Corporation information page.

What is an S Corporation?

S Corporations are a common election for small businesses. An S Corporation election allows income, losses, deductions, and credits to pass through to members or shareholders to be taxed at their personal income tax rate without being taxed at the corporate level.

Setting up and Filing for a Montana S Corporation

The first step in setting up your Montana S Corp is to form your Montana business with the Secretary of State by submitting all the proper paperwork to meet the filing requirement. We can help with that. Our Montana Corporation Formation Service and Montana LLC Formation Service simplify the process of getting your business started.

Once you have completed the formation process, we are happy to support your entrepreneurial ventures with business tools and services designed to make running and growing your own business a little easier.

1. Pick a Name for Your Business

Your business name ought to reflect the personality of your company while ensuring your purpose is clear. Make sure to adhere to all state naming requirements and limitations for your corporation or limited liability company.

Register Your Business as an S Corp

Enter your desired business name to get started

2. Choose a Registered Agent

A registered agent is a person or business that is officially designated to receive all business and legal correspondence. They must be available during all business hours, and it’s generally recommended to use a service rather than try to do this yourself—especially if you need to go on a coffee run.

3. Decide Who Will Serve as Directors or Managers

Corporations have directors and limited liability companies have managers. These designations are important for the formation process. The corporate board of directors and an LLC’s members and managers will be responsible for most major decisions regarding business operations.

4. File Articles of Incorporation or Articles of Organization with the Montana Secretary of State

Articles of Incorporation and Articles of Organization are the documents that formally create your corporation or LLC with the State of Montana. They contain basic information about your business, such as its name, its place of business, and the names and contact information of its directors or managers.

5. File Form 2553 to Elect S Corporation Status

Filing Form 2553 with the IRS is the final step to complete your business filings and elect an S Corporation tax structure. You will need to obtain your EIN first because it will be needed for you to complete the final business requirements to file an S Corp in Montana. Corporations will automatically default to C Corporations upon formation unless you elect S Corp status.

LLCs will need to file Form 8832 to elect corporate taxation before filing Form 2553.

S Corporation Requirements and Limitations

Though they are a great option for many businesses, S Corporations do have some limitations. The IRS requires your business to meet certain requirements to elect Montana S Corp status including:

- Be a domestic corporation or other eligible business

- Have only certain kinds of corporate shareholders, including individuals, estates, exempt organizations, and certain trusts, but not partnerships, corporations, or non-resident immigrants

- Have no more than 100 shareholders

- Have no more than one class of stock

- Not be an ineligible corporation such as an insurance company, international sales corporation, or a certain kind of financial institution

If you’re concerned about whether your business fits these requirements or if this is the right tax structure for your company, it’s a good idea to speak to a financial professional.

Pros and Cons of Creating a Montana S Corp

There are some great reasons to form a Montana S Corp, but there are also a lot of things to consider. Here are some of the pros and cons.

Pros

There is a lot to think about. Some of the benefits of an S Corp include:

- Protecting your personal assets

- Eliminating corporate double taxation

- Allowing you to use the cash method of accounting

Tax liability is a big concern for a lot of business owners. S Corporations address that concern with pass-through taxation. Instead of being taxed at the corporate level and personal level, taxes pass through to individual income taxes of the shareholders or members.

Cons

The type of business you have may impact whether a Montana S Corp is right for you. An S Corp can involve:

- Additional expenses for formation and maintenance

- Restrictions on issuing shares

- More extensive IRS oversight

- More stringent eligibility requirements

Double taxation is a concern for a lot of business owners, but may not be an issue for your particular type of business. If so, the cons of an S Corp may outweigh the pros.

What to know before creating an S Corporation in Montana

Just because the S Corp designation is beneficial for many doesn’t mean it works for every business owner. It’s good to know the pros and cons of this tax election to figure out if it’s the best for your particular business venture. One of the first things to know about starting a corporation is that it’s a C Corporation by default until you file the right paperwork and follow the right rules to make it an S Corporation.

What’s the difference between an S Corporation and a C Corporation?

The biggest difference between S Corporations and C Corporations is how they pay taxes. An S Corporation is a business entity that has elected to pass its corporate income, losses, credits, and deductions to its shareholders or members to include on their personal income taxes.

C Corporations are separately taxable entities and are subject to double taxation. Income is taxed at the corporate level and again on the individual tax returns of members or shareholders. C Corporations can also issue more stock than S Corporations.

What are the requirements to create an S Corporation?

To create an S Corporation, you have to form a business that falls within the limitations identified above. You must also file Form 2553 with the IRS not more than 2 months and 15 days after the beginning of the tax year the election is to take effect, or at any time during the tax year preceding that the election is to take effect. There are exceptions to the timeline if specific circumstances have prevented you from making a timely election.

Can LLCs choose an S Corporation election?

A limited liability company can elect to be an S Corporation. Many LLCs find this beneficial because corporations often require more formalities than starting an LLC. Learn more about LLCs and taxation on our Tax Information for Limited Liability Companies page.

We can help

If you’re ready to form your S Corporation, we are here to help. Making the election at the same time as forming your LLC or corporation will simplify the process. We are here to help support you from formation to compliance and maintenance so that you can spend more time focusing on growing your business.

Whether you’re in Helena or Missoula, our products and services are here to help you at any stage of your entrepreneurial journey.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in Montana

Enter your desired name to get started

Montana S Corp FAQs

-

Instead of being taxed at the corporate and personal level, taxes pass through to its shareholder and members at their individual income tax rates. S Corps also allow you to use the cash method of accounting.

-

There is no need to identify your LLC as an S Corp in the company name or on marketing material, but you must meet all IRS filing requirements.

-

Choose a name that reflects the personality of your company while ensuring your purpose is clear. Adhere to all state naming requirements and limitations.

-

S Corporation election allows income, losses, deductions, and credits to pass through to its members or shareholders to be taxed at their personal income taxes. It’s best to consult a tax professional to ensure you correctly file taxes for your business.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

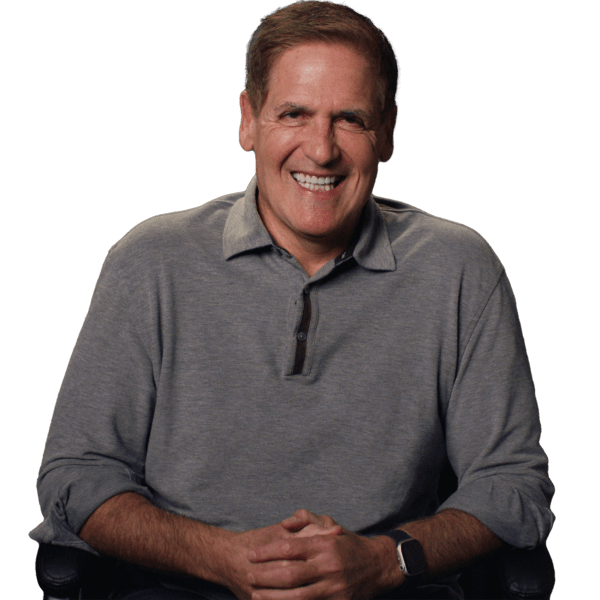

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

Montana Business Resources

How to File an S Corp in Your State

Ready to Start Your Montana S Corp?