Start an S-Corp in Louisiana

Are you an entrepreneur looking to set up an S Corporation in Louisiana? An S Corporation is a tax election, rather than a business structure, that can offer significant tax savings.

We can help you through the process of starting an S Corporation by providing in-depth information and handling your legal filings. In this step-by-step article, we explain the benefits of a Louisiana S Corp and the requirements of forming this type of business.

You can start the S Corp election process today with our simple business formation services. We make it fast and easy to start a Louisiana limited liability company (LLC) or Louisiana corporation.

Contact us to discuss Louisiana S Corporation and other formation options. Once you decide on the best business structure, we can support your business’s growth with our other useful tools and services. Our goal is to make it easy for you to take your passion from an idea to a fully operational business.

1. Choose a name

Before you can start your business, you’ll need to choose a name. We can help you find an available name for your business. Louisiana LLCs must contain the words “limited liability company,” “L.L.C.,” or “L.C.”

Register Your Business as an S Corp

Enter your desired business name to get started

2. Choose a registered agent

Every corporation and LLC in Louisiana needs to designate a registered agent to accept legal documents for your company.

3. Choose directors or managers

When choosing a business structure, know that corporations and LLCs have different management rules. Directors manage a corporation, while LLCs have managers. LLCs can be member-managed or manager-managed, and managers do not have to be members of the LLC.

4. File Articles of Incorporation or Organization with the Louisiana Secretary of State

To formally establish your business, you’ll need to file Articles of Incorporation for a corporation or Articles of Organization for an LLC. The Articles of Incorporation/Organization should include the name and address of your company and the business purpose. You’ll also provide the registered agent’s name and address and the preferred tax treatment of the company. On the Initial Report, you’ll list the names of the first directors or managers.

5. File Form 2553 to apply for S Corp status

To turn your business into an S Corp, you’ll need to file Form 2553 to elect S Corporation taxation. If you have an LLC, you’ll first have to elect to be taxed as a corporation rather than a partnership or sole proprietorship.

What to Know Before Creating an S Corporation in Louisiana

First, you probably want to know: What is an S corporation? A Louisiana S Corporation is a tax election instead of a business entity, but it offers tax advantages and some protections from liability. Keep in mind that a C corporation is the default election with the IRS, so you must take action to form an S Corporation.

Advantages of a Louisiana S Corp

What are the advantages of a Louisiana S Corporation? The IRS treats the Louisiana S Corp as a “pass-through entity.” This means that profits and losses pass through to shareholders without being taxed at the corporate level. C Corporations, on the other hand, are subject to double taxation—once at the corporate level and once on individual shareholders’ income taxes.

Filing as an S Corporation can also save business owners on self-employment taxes. This is because S Corp income is split into salary and distribution, and the IRS only requires owners of business corporations with S Corp status to pay 15.3% self-employment taxes on salary income. You don’t have to pay self-employment income taxes on distribution income.

What type of company can file as an S Corp?

The IRS allows only certain companies to file as an S Corporation. S Corps must meet the following requirements:

- Have only one class of stock

- Be owned by US citizens or resident aliens, including individuals and “certain trusts and estates”

- Have fewer than 100 members

When filing S Corp documents with the IRS, all corporation shareholders must sign Form 2553 Election by a Small Business Corporation.

Can LLCs choose an S Corporation election?

Yes, Louisiana LLCs can choose an S Corp election. Is an S Corp an LLC? Not necessarily, but an LLC can become an S Corporation for tax purposes by filing a form. An LLC may want to file as an S Corporation to gain tax benefits such as reduced self-employment taxes. Learn more about the tax consequences of business structures in our article, Tax Information for Limited Liability Companies.

Weighing the Pros and Cons of Creating an S Corp

Should you file as a Louisiana S Corporation? Here are points to consider before making this business decision.

Louisiana S Corporation Pros

An S Corporation offers many advantages:

- Allows for pass-through taxation

- Reduces self-employment taxes

- Allows for the cash method of accounting

- Provides business stability

These tax advantages can often save business owners significant money.

Louisiana S Corporation Cons

However, an S Corporation comes with some downsides:

- More expensive formation

- Tax qualification obligations

- Stock ownership restrictions

- Closer IRS scrutiny

- Can restrict a business’s growth

After considering these factors, you can discuss your business formation decision with us, and we’ll handle the Louisiana S Corporation filing requirements. That way, you can focus on what you do best—getting your business running and profitable.

We can help

When you contact us to assist with business formation, we’ll be there to support you every step of the way. We give you information to help you decide what business structure may be best for your company and then handle your formation filings. Before deciding on a business structure, consult your tax advisor about the benefits of an S Corp.

In addition to helping with any filing requirement, we can assist with business formation and continued compliance filings, making the business ownership process as easy as possible. Contact us to form your Louisiana S Corporation today.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in Louisiana

Enter your desired name to get started

Louisiana S Corp FAQs

-

An S corporation offers stability and tax advantages, such as pass-through taxation and a reduced S Corp tax rate for business owners.

-

We can help you find an available name by conducting a name and domain search for available Louisiana S Corporation name options.

-

An S Corporation offers tax advantages but isn’t right for every business. We can ask you questions to help you identify the potential risks and benefits of this business decision.

-

We can provide information on Louisiana S Corporation taxation. However, it’s best to consult a tax advisor before deciding on this business structure.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

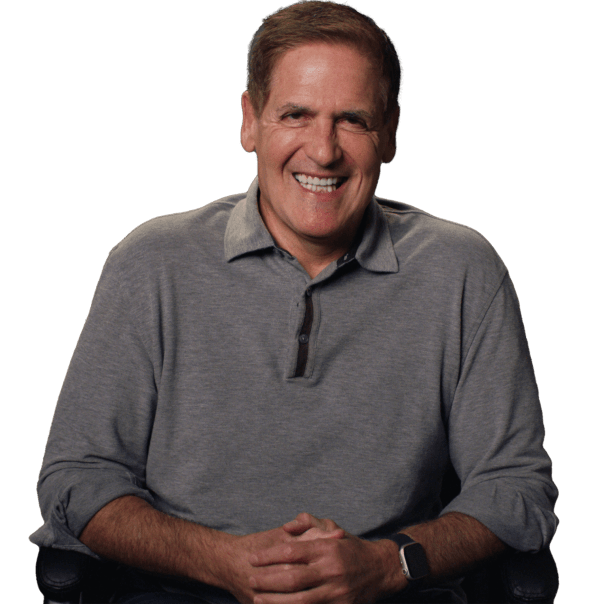

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

Louisiana Business Resources

How to File an S Corp in Your State

Ready to Start Your Louisiana S Corp?