Start an S corp in District of Columbia (DC)

Being a small business owner comes with risks and rewards. One of those risks is handling the unknowns of business taxation. But how can you save on federal taxes and maximize your business opportunities? Whether your business entity is a corporation or a limited liability company (LLC), a District of Columbia S Corporation, or S Corp for short, might help you save on your federal tax obligations.

What is an S Corporation?

An S Corporation in Washington, D.C. is not a business entity. It is a tax election that bears federal taxation benefits. They also aren’t subject to corporate double taxation, where corporate taxation applies. Before you can decide how you want to be taxed, you’ll need to form a business structure. The most common types are corporations and LLCs. We’ll walk you through how to get your entity formed.

How to Start an S Corporation in Washington DC

A Washington DC S Corp is not a formal business structure like a corporation or an LLC but rather a federal tax election approved by the IRS. This election allows income, losses, deductions, and credits to pass through to its shareholders to be taxed at their personal income tax rate. This avoids double taxation that takes place when business profits are taxed twice – first, on the corporate level in the form of corporate taxes and, second, when individual shareholders pay personal income tax.

1. Choose a Business Name

To form your District of Columbia corporation or LLC, you’ll need to follow a few simple steps to get up and running. The first step is to choose a name for your business.

The District of Columbia Council has certain requirements when naming your company. You’ll need to include an identifier like “incorporated” in your business’s name if forming a corporation or “LLC” if forming an LLC.

Be sure to check the requirements before getting your heart set on a name.

Name Your District of Columbia (DC) S Corp

Enter your desired business name to get started

2. Appoint a Registered Agent in Washington DC

Next, you’ll want to select a registered agent for service of process in Washington, D.C. A registered agent acts as your go-between when the government wants or needs to reach you for routine matters. This is required for both corporations and LLCs.

The registered agent can be a person or business who has a local mailing address and are available during normal business hours. Since you most likely need a registered agent, check out our Resident Agent Service.

3. Choose Directors or Managers

Once you’ve got a statutory agent in place, you’ll want to select directors or managers to help you run your company. Directors help run corporations and corporate boards, and LLCs can have managers or members. Choose wisely, as you’ll generally need to disclose their identities in your operating documents.

4. File Formation Documents

With your directors or managers in place, you can file your Articles of Incorporation or Organization with the DCRA. You’ll be able to file your completed documents online. Once these are filed, congratulations! You have taken the first steps in creating your S Corp.

5. File Form 2553 to Turn Business into an S Corporation

To make your company an S Corp, you need to obtain your business’s tax identification number. Known as an Employer Identification Number (EIN), this number identifies a business to various tax authorities. After you’ve received your EIN, you can decide what tax election you want to make for your business.

You’ll complete and file Form 2553 with the Internal Revenue Service (IRS) to finish forming an S Corp in the District of Columbia. The IRS provides helpful instructions with Form 2553. Deadlines may vary depending on how long your business has been established and your tax year. Make sure to check the Form 2553 instructions or speak with an accountant to ensure compliance.

District of Columbia S Corporation Requirements and Limitations

Unlike many states, the District of Columbia doesn’t recognize S Corporations for local tax purposes. It taxes all corporations like C Corporations (which we’ll explain in a moment). In Washington, D.C., LLCs have a few tax options, but most involve several levels of taxation. Despite these local tax issues, District of Columbia S Corp status may still make good tax sense for self-employed business owners. The federally recognized S Corp election may help you save on federal self-employment tax.

When considering whether to elect District of Columbia S Corporation status, you need to know that there are limitations on who can elect to become an S Corp. Before making the election, make sure your company meets District of Columbia S Corporation requirements:

- One class of stock

- 100 or fewer shareholders

- Shareholders are U.S. residents, estates or trusts, or tax-exempt organizations

- Domestic business entity

If you meet these requirements, then you may want to file Form 2553 and elect District of Columbia S Corporation status for federal tax purposes. However, if you’re looking to raise capital through building a large shareholder base, or if you’re not sure of your existing shareholders’ tax residences, make sure to speak with an experienced tax lawyer before making your tax elections.

What to Know Before Creating a District of Columbia S Corp

We’ve used the terms S Corporation and C Corporation above. While most business owners are familiar with these terms, it’s important to clarify. A District of Columbia S Corporation or C Corporation is a way to classify your business for tax purposes. They’re not types of business entities. An S Corp election helps the IRS distinguish which parties associated with your business should be taxed at a corporate tax rate and which at an individual.

What’s the Difference Between an S Corporation and a C Corporation?

Generally, there are two main differences between an S Corp and a regular C Corporation.

- Income from C Corporations is taxed at both the corporate level and again when distributed to individuals, creating a system of “double taxation.”

- Income from S Corps isn’t taxed until it’s distributed to members or shareholders in a system known as “pass-through taxation.”

In Washington, D.C., S corporations are not entirely tax free. The District of Columbia has an Incorporated Business Franchise Tax and an Unincorporated Business Franchise Tax. This means that all businesses, including pass-through entities, are charged state taxes in the District of Columbia, regardless of tax election. The minimum franchise tax varies depending on the size of the business – $250 for gross receipts $1 million or less and $1000, if they exceed $1 million.

What are the requirements to create an S Corporation?

To create an S Corporation, your business needs to fall within the limitations identified above about who can be an S Corporation. You also have to file Form 2553 with the IRS within one of the timeframes applicable to your business.

Can LLCs choose an S Corporation election?

Typically, LLC business owners elect S Corp status to avoid double taxation. That’s unavoidable in the District of Columbia. However, we provide great tax resources for small business owners that can help guide you through some of the benefits of District of Columbia S Corp status for self-employed business owners.

We can help

We help entrepreneurs handle tax and business compliance, so they can focus on what they love to do. Our S Corp formation service can help your District of Columbia LLC or corporation get the right tax treatment for your business needs.

Whether it’s an LLC that your business needs or a District of Columbia Corporation, we can help get your entity formed and operating quickly. If you decide that a District of Columbia S Corp is right for you, we can help! And once your business is off to the races, our specialty is helping you with your other filing requirements and business compliance needs.

We have all the tools and services your business needs no matter where you are in your entrepreneurial journey. Let us know how we can help you get started.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in District of Columbia (DC)

Enter your desired name to get started

District of Columbia (DC)

S Corporation FAQs

-

Some benefits of being a District of Columbia S Corp include limited liability protection of personal assets and favorable federal tax treatment for self-employment income.

-

Check with a trusted lawyer or accountant to confirm the best tax treatment of your business before you confirm an S Corp election, especially since S Corp protections in the District of Columbia are limited.

-

Washington D.C. S Corps are tax elections, not entity types, so you won’t need a new name if you’ve already formed your entity.

-

Talk with your accountant or bookkeeper about how to calculate your District of Columbia S Corp taxes.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

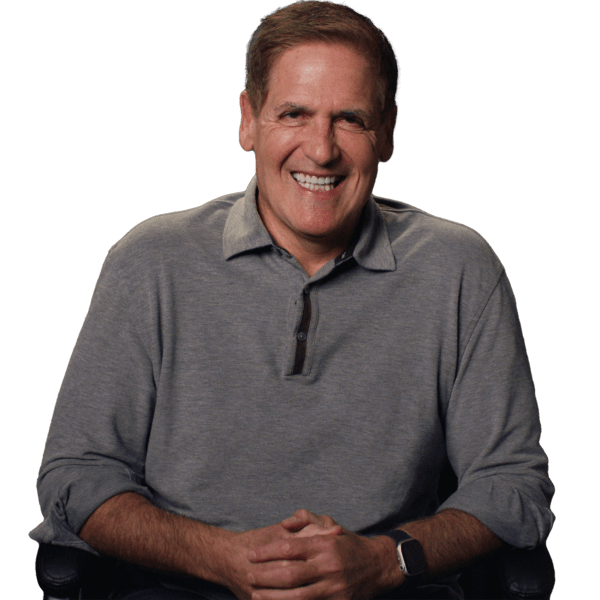

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

District of Columbia DC Business Resources

How to File an S Corp in Your State

Ready to Start Your District of Columbia (DC) S Corp?