Start an S corp in South Carolina

Running your business isn’t always easy. The rewards of business ownership are high, but so are the risks. A possible solution is to establish an S Corporation. An S Corp is not actually a separate entity type like an LLC or corporation. An S Corp is a tax election that can be made with the IRS. Accordingly, an S Corp election is typically made for tax reasons.

A South Carolina S Corporation can be a great option, but the process of actually creating it can be confusing. Because an S Corp is an election and not a formal entity, you will need to form a limited liability company (LLC) or a corporation and then convert it to an S Corp.

Fortunately, our Corporate Formation Services and LLC Formation Services make creating an entity and converting it to a South Carolina S Corp a breeze. We don’t just help you create your business entity though! Check out our other services that help you keep your business going strong.

How to Form an S Corporation in South Carolina

Read on to learn more about forming your S Corp in South Carolina.

Step 1: Choose a name

You can pick just about any name you want in South Carolina. However, there are a few rules. For one, the name can’t be the same or substantially similar to another entity’s name. South Carolina corporations will also need to have some sort of variation of “corporation,” “incorporated,” “company,” or “limited” in their name. LLCs need to have a variation of “limited company,” or “limited liability company.”

Register Your Business as an S Corp

Enter your desired business name to get started

Step 2: Appoint a registered agent

You will also need to pick a registered agent for your entity. This is simply a person or entity you appoint to receive official notices and legal documents on behalf of your entity. The registered agent doesn’t have the right to act on the entity’s behalf.

Step 3: Elect directors or managers

Your S Corp will need to have a governing body. If your entity is a corporation, you will need directors. If you have an LLC, you will need managers. You can appoint the owners of the company to be directors or managers or you can hire non-owners to fill those positions.

Step 4: File Articles of Incorporation/Organization with the South Carolina Secretary of State

To form a corporation, you will need to file Articles of Incorporation with the South Carolina Secretary of State (SOS). For an LLC, you will need to submit Articles of Organization to the SOS. We can help you prepare either of these forms if you use us to form your entity.

Step 5: File Form 2553 to turn business into an S Corporation

You will need to file IRS Form 2553 to convert your entity into an S Corp. If your entity is an LLC, you may need to elect to be taxed as a corporation first by filling out IRS Form 8832. The conversion to an S Corp can only be made at certain times. To convert your entity within the same year, the conversion must be filed within the first two months of the tax year. Even after the first two months, you can still file Form 2553, but the conversion won’t occur until the following year.

What to Know Before Creating an S Corporation in South Carolina

An LLC or corporation can’t elect S Corp status without meeting certain requirements. The entity:

- May not have more than 100 owners

- Must be owned by U.S. residents, trusts, or estates

- Must have only one class of stock

- May not be an ineligible entity such as a financial institution or insurance company

Failure to meet any of these requirements may prohibit you from electing S Corp status.

What is an S Corporation?

An S Corporation in South Carolina is a pass-through entity. This means that the income from a South Carolina S Corp passes directly to its owners. So instead of paying a tax on corporate income and dividends, S Corp shareholders pay income taxes only at the personal level.

Because an S Corp can only be an LLC or corporation, this means South Carolina S Corps will also have limited liability. This means you can’t typically be held personally liable for the debts and liabilities of the company.

What is the Difference Between a South Carolina S Corp and a C Corp?

As mentioned above, S Corporations in South Carolina are taxed as a pass-through entity. This is in contrast to a typical C Corp, where the corporation itself pays corporate income taxes on income earned by the business.

In a C Corporation, when dividends are issued to shareholders to distribute these profits, the shareholders themselves will pay taxes as well. In other words, owners of the company can be effectively taxed twice. The pass-through taxation of an S Corp simplifies how taxes are handled and can help avoid double taxation issues. Accordingly, the S Corp tax rate may be better than that of a C Corp.

Can LLCs Choose an S Corporation Election?

Yes! An LLC can also elect S Corporation status. Most LLCs that convert do so for tax reasons. Generally, LLC owners are liable for self-employment taxes on net earning.

With an S Corporation, you may be able to avoid self-employment taxes if you pay yourself a reasonable salary. This wouldn’t remove social security and medicare withholding requirements though. You can learn more about LLC taxation issues on our LLC Tax Information page.

Pros and Cons of Forming a South Carolina S Corporation

Deciding whether a South Carolina S Corp is right for you largely depends on your needs and your business.

Benefits of an S Corp:

- Limited liability protects personal assets from business debts and liabilities

- Pass-through taxation can simplify the tax treatment of the business

- May be able to avoid double taxation issues seen with C Corps and employment taxes with LLCs

S Corps have their own downsides. The main cons of an S Corp include:

- More expensive and complicated than a sole proprietorship

- Ongoing maintenance requirements

- You could face tighter IRS scrutiny when you employ yourself through the S Corp

You might consider consulting with a tax professional to determine whether an S Corp election will benefit your business.

We Can Help

We understand how overwhelming all this may seem. Our team can help you through every step of the process as you form your entity and transform it into a South Carolina S Corp. As soon as your new company has been formed, we can help you keep it running smoothly. Whether you need a Business Plan, an EIN, or want Worry-Free Compliance, we want to help you keep your business running.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in South Carolina

Enter your desired name to get started

South Carolina S Corporation FAQs

-

With South Carolina S Corps, you get both the liability protection of a corporation and the simplified tax treatment of an LLC.

-

You can choose nearly any name when you use our Formation Services! You just need to check that your business name is not already taken. You will also need to comply with South Carolina naming requirements.

-

S Corporations are a good option if you plan on paying yourself a reasonable salary because of the ability to forgo employment taxes.

-

As a pass-through entity, you will typically pay taxes like you would your personal income. Consult with a tax professional for help with your individual taxes.

Disclaimer: The content on this page is for information purposes only, and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

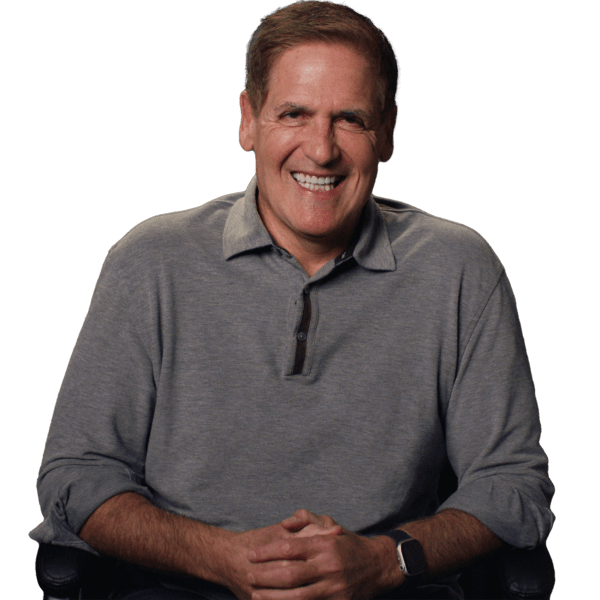

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

South Carolina Business Resources

How to File an S Corp in Your State

Ready to Start Your South Carolina S Corp?