How to Start an S-Corp in Minnesota

For those looking to form a business with asset protection and favorable tax advantages, an S corporation in Minnesota can be a great option. If you’ve done a bit of research and feel that it can work for you, then our guide can help you get started.

What is an S Corp?

While not a formal business structure like a limited liability company (LLC) and C Corp, an S Corp is actually a federal tax classification approved by the Internal Revenue Service (IRS) that you can elect for your business. Should you choose to make an S Corp election for your Minnesota business, your entity will then be permitted to pass its income, losses, deductions, and credits through to its shareholders for taxation at the shareholder level on their individual income taxes.

Who can apply for S Corp status?

Limited liability companies (LLCs) and corporations (C Corps) can benefit from filing as an S Corp. An LLC can save on self-employment taxes and C Corps can avoid double taxation. To learn if filing as an S Corp can help your business, check out our “What Is an S Corporation?” page. If you plan to start an LLC with an S Corp status, then check out our S Corp service. We also offer other services to help you run and grow your business.

Filing as an S Corp in Minnesota

You’ll first need to form an LLC or C Corp in order to file for S Corp status. After your business is created, you can file an election form with the IRS. Our guide will walk you through the process of filing as an S Corporation in Minnesota. Read on and take note of each step.

1. Choose a Name

Whether you choose a corporation or LLC as your entity’s structure, your first step toward creating your Minnesota S Corp is to choose a name for the business. While this may sound simple, there are a number of formalities you have to comply with depending on which entity type you select. You can do this with some additional research. Also consider that your business’s name is its identity, so choose one that will attract customers.

Reserve your business name

It’s also important to check the state’s business records to ensure that another entity isn’t already using the name you have in mind. When you’re ready to lock something down, we can help you reserve your business name to prevent others from taking it while you finish the registration process.

Register Your Business as an S Corp

Enter your desired business name to get started

2. Choose a Registered Agent

Next, you’re ready to choose a Minnesota registered agent for your business. You should know that corporations and LLCs in Minnesota must have a registered agent in order to remain in compliance.

What does a registered agent do?

A registered agent will serve as the official recipient for any service of process and other legal notices. The registered agent can be either a person or a business registered to perform this duty. Having someone reliable and trustworthy is crucial since a registered agent must be present at their registered address during normal business hours.

Keep in mind that a registered agent does not perform any legal duties. They simply accept legal documents and notices on your business’s behalf.

3. Choose Directors or Managers

The next step is to select the individuals who will run the business. For a corporation, these people are referred to as directors. For an LLC, on the other hand, these will be either members or managers depending on how you want to structure the LLC.

4. File Articles of Incorporation or Articles of Organization

Finally, you’re ready to formally register your business with the state. For a corporation, you’ll do so by filing what’s called Articles of Incorporation. For an LLC, the formation document is called the Articles of Organization.

After filing the appropriate document with the Minnesota Secretary of State, you will have formed a legal Minnesota business entity.

5. File Form 2553 to Turn Business into an S Corporation

Once you’ve set up the legal business entity, you’re ready to make your S Corp election. To do so, you’ll need to file your Form 2553 with the IRS. However, for LLCs, before filing your Form 2553, make sure to first change your entity classification to Corporation status by filing IRS Form 8832.

Also, don’t forget to first get an Employer Identification Number (EIN) for your business. We can help you obtain one from the IRS today.

S Corporation Requirements and Limitations

Making an S Corp election for your Minnesota business can provide a number of benefits. However, not all entities will meet the Minnesota S Corporation filing requirements.

Specifically, to qualify to make a Minnesota S Corp election, your business must:

- Be a domestic corporation

- Have only allowable shareholders, such as individuals, certain trusts, and estates

- Have no more than 100 shareholders

- Be an eligible business — certain financial institutions, insurance companies, and domestic international sales corporations are ineligible

- Have only one class of stock

Even if you do qualify, an S Corp classification might not be the right fit for your business. Thus, if you’re not sure whether to make an S Corp election, contact a legal or tax professional to discuss the best options for your business.

The pros and cons of creating an S Corporation

Although there are a variety of benefits associated with making an S Corp election, there are certain disadvantages to be aware of, too. Thus, be sure to carefully consider both the competing pros and cons before deciding how you want to proceed.

Advantages of forming an S Corp include:

- Asset protection

- Pass-through taxation

- Tax-favorable characterization of income

- Ability to utilize cash method of accounting

However, there are drawbacks to take into account as well. Some cons of forming an S Corp include:

- Higher formation and maintenance expenses

- Tighter tax qualification obligations

- Stock ownership restrictions

- Closer IRS scrutiny

- Less flexibility in allocating income and losses

So, should you form an S Corp for your Minnesota business? Unfortunately, the answer to this question will vary from entity to entity. Ultimately, the decision depends on the particular needs and goals of your business.

What to know before creating an S Corporation in Minnesota

Before deciding to make an S Corp election for your Minnesota business, there are a few important things to note. For example, by default, your business will be set up as a C Corporation. This will be the case unless and until you file the necessary paperwork to make the change to an S Corporation.

Below is some more information on what to know before creating an S Corporation in Minnesota.

What’s the difference between an S Corporation and a C Corporation?

There are a few key differences between S Corporations and C Corporations.

For example, C Corporations can issue more shares and classes of stock than S Corps. For many business owners, however, the primary difference is that S Corps benefit from pass-through taxation, meaning that the entity itself doesn’t have to pay taxes on its income. C Corporations do have to file and pay income taxes at both the corporate level and at the shareholder level.

Can LLCs choose an S Corporation election?

Yes, LLCs can make an S Corporation election. And in fact, many owners choose to form an LLC to benefit from the lower start-up costs and flexibility of that business entity. After forming their LLC, they then elect an S corp IRS classification to benefit from the various associated tax advantages.

We can help

Starting a new business can feel overwhelming at times, but we’re here to make the process and smooth as possible. We’ve made it our mission to support owners throughout the business lifecycle from start to finish. When you’re ready to form an S Corp in Minnesota, we can help you get started and assist you at every step along the way after the formation process is complete.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your S Corp in Minnesota

Enter your desired name to get started

Minnesota S Corp FAQs

-

One of the biggest advantages of creating an S Corporation, as opposed to keeping the default C Corp status, is the ability to avoid double taxation. Instead, S Corps are able to benefit from pass-through taxation and avoid taxation at the corporate level.

-

As long as you comply with any applicable state naming formalities, you can usually select any name for your Minnesota S Corporation. However, don’t forget to search the Minnesota business entity records to verify that your preferred name isn’t already taken by another business operating in the state.

-

Just because you can identify your LLC as an S Corp doesn’t necessarily mean you have to or even should. Doing so may not be right for all business entities, but creating a detailed business plan early on can help you assess your business needs and goals to make the right decision for your business. If you’re still not sure how to proceed, it’s recommended that you consult with an experienced legal or tax professional to discuss your options.

-

Calculating taxes can be confusing, but we’re here to help. Check out our S Corp tax guide to learn more about navigating taxes for your Minnesota S Corporation. If you have questions, contact a certified tax professional for more information.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

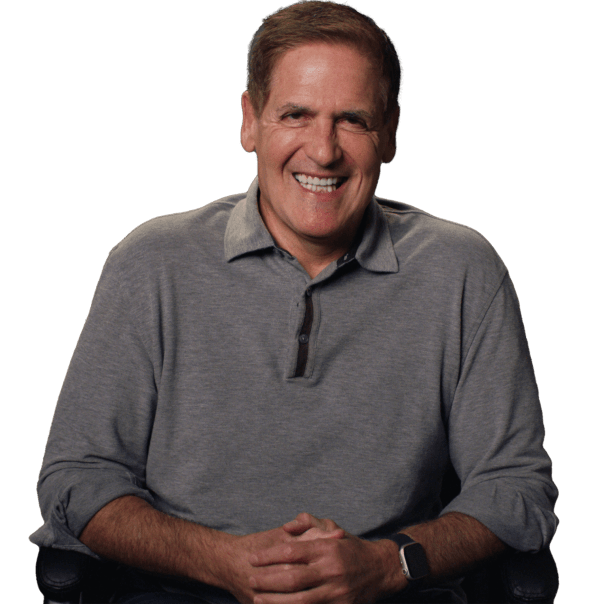

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

S Corp Resources

Minnesota Business Resources

How to File an S Corp in Your State

Ready to Start Your Minnesota S Corp?