How to Start an LLC in Arizona

Want to launch your business as a limited liability company (LLC)? Arizona, with its business-friendly climate and scenic state parks, could be the right place. In fact, The Motley Fool rated the Grand Canyon State among the top 10 states to start your small business in 2021.

To create an LLC in Arizona, you’ll need to follow certain steps. And, if you want to take advantage of the liability protection and tax benefits of an LLC while avoiding delays and costly fines, you’ll need to follow those steps carefully.

Trying to follow all the rules for creating an LLC in Arizona can be trickier than dodging wildlife on the Beeline Highway. But don’t sweat. This guide can help you with setting up an LLC in Arizona.

Starting an LLC in Arizona

To form your LLC, you must register your business in Arizona with the Arizona Corporation Commission (ACC). This process enters your new company into the public record. It provides the information necessary for the state to communicate with and regulate your new limited liability company.

You’ll also need to choose a statutory agent. Your Arizona statutory agent receives legal notices and official correspondence from the state.

After you file the required paperwork, you’ll still have some other boxes to check. For example, you’ll likely want to draft an operating agreement and register your company with the IRS. The state also requires you to publish notice of your LLC in Arizona in an approved newspaper.

AZ LLC in 6 Steps

Below, we’ll show you how to start an LLC in Arizona with six key steps. We’ll also include some other helpful information to set up your LLC for success. Along the way, we’ll also show you how our services can further cut through the red tape so you can get to the more enjoyable parts of running your new business.

Note that these guidelines are for starting a domestic LLC, which is one started within the state you’re residing in. A foreign LLC is one that originated in a different state. To register a foreign LLC in Arizona, you would complete a registration statement for a foreign LLC and follow a different process.

Step 1: Name your AZ LLC

The first step is to name your limited liability company. This can be the most fun step, but picking the perfect business name is more than just branding. Without a unique name, the ACC won’t let you register your business.

You’ll need to decide what to call your company before forming your LLC and submitting the necessary paperwork. Otherwise, you might have to start over. Come up with several name options in case your first choice isn’t available.

Official Naming Requirements for Arizona LLCs

Unfortunately, you can’t just choose the first name that pops into your head. You’ll have to follow Arizona’s requirements (A.R.S. § 29-3112) for LLC names:

- Your LLC’s official name must be unique in the state of Arizona. If a business is already using the name you prefer, you’ll need to go with another option. Name search engines aren’t perfect, so we recommend also calling the ACC at (602) 542-3230 to double-check your name’s availability.

- Your LLC name can’t contain the words “association,” “corporation,” “incorporated,” or an abbreviation of those words. Certain other words, such as “bank,” “credit union,” and “trust,” require prior approval.

- Your Arizona LLC name must end with some form of the phrase “LLC.” Your options are “limited liability company,” “limited company,” or one of the following abbreviations in uppercase or lowercase letters: “L.L.C.,” “LLC,” “L.C.,” or “LC.”

Reserving a Business Name in Arizona

Once you select a name, consider reserving it so that nobody else can take it before you form your business. To do this, you can use our name reservation service, which will save your chosen limited liability company name for 120 days.

Within that window, you should have enough time to file your Articles of Organization and form your LLC.

Get a domain name for your business

Having an online presence is critical for most businesses. Consequently, when you’re deciding on your LLC’s name, consider choosing one that pairs well with an available domain name.

For example, if your first choice of name doesn’t have any available domain names but your second choice does, that could sway your decision toward the second name.

Is your Arizona LLC name available as a web domain?

One factor worth considering when deciding on an LLC name is its availability on the web. Finding a business name you like that’s also available as a URL means you’ll have a website that’s easier to find and remember for clients.

You can use our domain name search tool to see if your desired business name is available as a URL. If you find such a domain name, you might want to snatch it up before someone else does.

You can also check to see if social media handles are available. Many businesses market on platforms like Facebook, Instagram, and Pinterest, so snagging the appropriate social media names can be important for effective online marketing.

We have a domain name service to help you find and purchase a domain name for your company. We can also help you create a business website and provide domain name privacy.

Trademarking Your Arizona LLC’s Name

Even if the ACC shows that your business name is available in the state database, that doesn’t necessarily mean you’re clear to use it. Business names can be trademarked on both the federal and state levels.

For federal trademarks, check the search engine on the U.S. Patent and Trademark Office website to see if someone’s already trademarked your desired name.

For Arizona trademarks, you can search the Arizona Secretary of State website page for trademarks. If your desired name is untrademarked, you can consider applying for a trademark of your own.

Filing for a DBA in Arizona

If you plan to do business under a name different from your LLC’s legal name, you’ll need a DBA or “doing business as” name in Arizona. DBAs also need to be registered via the Secretary of State’s website.

Businesses sometimes use a DBA, known as a “trade name” in Arizona, if they want to open a store under a different name or launch a new product line without starting another business.

Name your LLC

Enter your desired business name to get started

Step 2: Appoint an Arizona statutory agent

Appoint a statutory agent for your LLC. The state requires you to have a statutory agent, known as a “registered agent” in most states, to accept legal and official government notices in person.

If a process server or the state needs to contact your business, they need a clear point of contact. That’s what a statutory/registered agent is for. The agent needs to be available at a set physical address (called a “registered office”) within Arizona during business hours so that they can receive such notices in person and relay them to your LLC’s leadership. The registered office does NOT have to be your LLC’s principal office.

Who can be a statutory agent in Arizona?

The agent can be an individual with a physical street address in Arizona or a corporation or LLC authorized to do business in Arizona, provided they have a place of business in the state. A P.O. box won’t work because some notices must be accepted in person.

Also, the agent must accept the appointment in writing by completing a Statutory Agent Acceptance form, which you’ll submit along with the Articles of Organization.

Should I be my own statutory agent?

Many business owners assume they should serve as the statutory/registered agent for their company and use their business’s primary location as the registered office address. This may sound reasonable at first, but there are downsides.

You don’t want to be served with a lawsuit in front of customers (or anyone else, really). Plus, being your own agent tethers you to the office all day, making it difficult to go meet clients, go on vacation, have a sick day, etc.

Consider using a statutory agent service for your AZ LLC

Using statutory/registered agent services like ours allows you to avoid the scenarios above and helps ensure you’re in compliance with the law. Plus, using a statutory agent service means that you won’t have to change your agent’s address with the state if your place of business relocates to another part of Arizona.

Arizona LLC owners get an added benefit from our statutory/registered agent service: All but two counties in Arizona require you to meet a publication requirement when forming your LLC (more on that below). When you use our service, our Arizona office is located in one of the two counties that don’t require publication, meaning you avoid the hassle and costs of the state’s publishing requirement.

What if the state can’t find my Arizona statutory agent?

If you’re acting as your own statutory agent in Arizona or have appointed a friend or family member to be your agent, you could incur the wrath of the state if they’re not able to find you or your appointed agent.

This can happen pretty easily if you or your appointee isn’t in the office (for example, out of town, on vacation, sick, etc.) when they try to reach the agent. It can also happen if the agent moves or quits and you forget to update your paperwork with the state.

Failing to maintain a statutory agent could mean that the state will dissolve your LLC in Arizona, and you’ll lose your liability protection (which was likely the main reason you started an LLC in the first place). Another scary prospect could be that a process server can’t find you to notify you of a lawsuit. In that scenario, a court case against you could actually go forward without your knowledge.

ZenBusiness can be your statutory agent

One of the many services we offer is our registered agent service. When you sign up, we’ll act as your statutory agent, meaning that there will always be someone available to receive important legal, tax, and other notices from the state.

Not only will this keep you in compliance, but it avoids scenarios where you could be served papers for a lawsuit in front of clients.

Our service also keeps you organized. When you get important documents, we will quickly inform you and keep them together in your online “dashboard” so that you can view, download and/or print them whenever you want. No more digging through piles of papers to try to find misplaced critical documents.

Step 3: File Arizona Articles of Organization

File your Articles of Organization with the Arizona Corporation Commission. Once approved, this step officially creates your Arizona LLC.

Filing government documents like this can be intimidating, which is why our service exists. With our business formation plans, we handle the filing for you to make sure it’s done quickly and correctly the first time. But, although we can do this for you, we’ll show you how the process works below.

Create an eCorp account to file Articles of Organization

To file your Arizona Articles of Organization online, you’ll need to create an eCorp account on the Arizona Corporation Commission website and pay a $50 fee.

How fast can I form my Arizona LLC?

If you’re ready to launch and don’t want to wait weeks for your paperwork to get processed, we can help. You can form your LLC in Arizona in as little as one day with our rush filing services. With our rush filing service, we prioritize your formation paperwork so you can get it filed with the Arizona Corporation Commission within 1-4 business days for just $100 + state fees.

Information Needed for Arizona Articles of Organization

Have the following information handy before you complete your Articles of Organization:

- Your Arizona LLC’s name

- Your statutory agent’s name and address. A separate agent Acceptance form (M002) must be signed and submitted along with these Articles of Organization.

- Whether your LLC will be a professional LLC (for lawyers, medical professionals, and other professional services)

- The mailing address for your business (this can be different from the registered address)

- An election as to whether your LLC will be member-managed or manager-managed. A member-managed LLC is governed by the owners of the LLC, who are called “members”; a manager-managed LLC is managed by a manager who is appointed or hired by the owners.

- The signature of the LLC’s organizer

Member-Managed or Manager-Managed?

Like many states, Arizona asks you to decide how you plan to govern your LLC, by the members/owners (member-managed) or by a manager (manager-managed).

Most LLCs choose to be managed by the members because they only have a few owners or just one. In those cases, it usually makes sense for the LLC owner(s) to do member-management because they’re running the business themselves. All of the owners are sharing in running the business and making decisions for it.

But some LLCs prefer to appoint or hire a manager instead. In the manager-managed option, one or more LLC members can be appointed to make management decisions, or someone from outside the LLC can be hired to manage the company.

Manager-management can be helpful when some of the members only wish to be investors in the company as opposed to running the business and making decisions about it. LLCs with many members also sometimes find it easier to have a manager because it’s difficult to get all the members together to make decisions.

You only need to file your Articles of Organization once. However, if you end up making any changes down the road — such as replacing your statutory agent or switching your management type — you’ll need to file Arizona Articles of Amendment with the ACC along with a fee.

If you do need to file an amendment, we have an amendment filing service that can handle it for you as well as our Worry-Free Compliance service, which includes two amendment filings every year.

Why would I delay my Arizona LLC filing date?

Some entrepreneurs, especially if it’s near the end of the calendar year, will delay their LLC filing date to January 1 of the coming year. This way, they can avoid the hassle and cost of having to pay taxes on an LLC in the current year. This is especially true if the future LLC owners don’t need to establish the company right away.

Ordinarily, if the Arizona Corporation Commission approves your filing, the filing effective date will be the date you submitted it. This is true even if it takes longer than that for the state to examine it and mark it as filed. In other words, if you submit your filing on July 1, but the state doesn’t approve it until July 30, your LLC effective date would still be July 1.

But you also have the option to tell the state that you want your effective date to be at a later time. You can choose to have your LLC’s effective date be up to 90 days past the date you submit the filing.

This is something else we can help you with. When you form your LLC in Arizona with us, we give you the option of paying an extra fee to have your LLC’s effective date delayed. (This service is only offered from October to January.)

Store all your LLC documents in one digital dashboard

If you have us file your Articles of Organization, once the state approves your LLC, your paperwork will be available from your ZenBusiness dashboard. There you can keep it and other important paperwork digitally organized.

Professional LLCs

When completing the Articles of Organization, you’ll be asked whether you’re forming a professional LLC (PLLC) in Arizona. Arizona law says that those in certain licensed professions (think doctors, lawyers, architects, engineers, etc.) who want to offer their services under an LLC structure may do so only as a professional LLC.

If you’re in such a profession, check with the agency or board that licenses your profession to see if it requires you to form a PLLC. Note that we at ZenBusiness don’t handle PLLC formations at this time.

Stay organized

Once you get your physical paperwork back from the state approving your new LLC, you’ll want to keep it in a safe location along with your other important legal documents, such as your operating agreement, member certificates, contracts, compliance checklists, etc. We offer a customized business kit to help you keep these important documents organized and looking professional.

Step 4: Create an Arizona operating agreement

Next, create your Arizona operating agreement to spell out how your LLC will be organized and operated. Though this isn’t a legal requirement, it provides many benefits and helps you avoid future hassles.

An operating agreement (OA) clearly defines the terms of ownership and management for an LLC. And, without one, you’ll be subject to Arizona’s default rules for LLCs, which might not reflect the wants of yourself and the other members.

Benefits of AZ LLC Operating Agreements

Here are some of the benefits an OA offers to owners of an LLC:

- Agreements help prevent and resolve conflicts between LLC members by clearly indicating the powers and privileges of each member.

- Creating an OA empowers you to customize your business’s rules and procedures to serve your LLC’s interests, requirements, and expectations.

- An agreement can define your LLC’s management structure. While some companies choose to be member-managed, others designate a manager to run day-to-day operations.

- An OA helps separate your business from your personal assets in the courts’ eyes, further sheltering your savings from legal liability.

- A well-drafted agreement specifies the rules and procedures to guide the LLC if you want to add or remove members from the business.

- It creates a plan of succession for when a member passes away, which is useful even for single-member LLCs. The agreement can stipulate what happens to that member’s portion of the business.

What should I include in my LLC operating agreement?

Here are some basic items you may want to include in your LLC’s OA:

- Ownership allocation: While many LLCs split ownership evenly among the members, Arizona law permits business owners to allocate ownership and profits however they wish. For example, if you have a multi-member LLC, you could decide that one member has 60% ownership, while the other two members each have 20%.

- Management regime: In Arizona, you can choose to have your LLC managed by its members or a manager — you’ll have to specify in your Articles of Organization.

- Authority to act on behalf of the business: Who can take action on the business’s behalf? Who can sign checks for the LLC? Who’s in charge of negotiating major agreements? What percentage vote is required for routine and major decisions? Your agreement should clearly outline each individual’s responsibilities and authorizations.

- Admitting new owners: If your business is successful, you might invite new individuals or businesses to join your LLC as business partners. If you want to admit new members into your LLC, your agreement should specify the requirements and processes to join the membership. You’ll also want to lay out the procedure for removing members, buying out their interest, and repaying them for any remaining debt.

- Dissolution and winding up: At some point, you may want to close your business and move on to something new. Your OA can make this easier by including provisions for dissolving and winding up the LLC. Common issues upon dissolving a business include selling the business’s assets, paying off debt, and distributing remaining profits among the existing members. You’ll also need to file Articles of Dissolution with the Arizona Corporation Commission.

Unsure as to how to start creating an OA for your LLC? We offer a customizable template to help get you started.

Do I need an operating agreement if I’m the only owner?

Because it seems like most of the things in your OA are geared toward avoiding disputes among the LLC members, you might think you don’t need one for a single-member LLC. But potential investors, future business partners, and others may want to see your OA.

Some banks won’t let you open a business bank account without one. Your OA can also spell out what you want to happen to the business if you die or become incapacitated.

Further, occasionally someone will take an LLC owner to court to try to prove that the owner and the LLC are the same entity so that they can go after the owner’s personal assets. If that happens, having an OA in place is one more thing to further demonstrate to the court that the owner and the LLC truly are separate.

Step 5: Apply for an EIN

Register your LLC with the federal government by getting an Employer Identification Number (EIN), also known as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number, from the Internal Revenue Service (IRS).

An IRS Employer Identification Number is like a Social Security number for your business, allowing your business to hire employees, apply for a business bank account, and pay taxes. Most LLCs are required to have an EIN, especially those with multiple members or employees.

Sometimes a single-member LLC with no employees or excise tax liabilities can forego having an EIN and use the owner’s Social Security number instead. But even these LLCs will likely need an EIN to open a business bank account.

You can get your LLC’s EIN through the IRS website, by mail, or by fax, but if you’re not fond of dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle.

Register for Arizona Business Taxes

Before you conduct business activity that’s taxable in Arizona, you’re required to register with the Arizona Department of Revenue for transaction privilege tax (TPT) and withholding purposes.

The Arizona TPT is a tax on a vendor for the privilege of doing business in the state. A TPT license, also known as a sales tax, resale, wholesale, vendor, or tax license, is required for any business that sells a product or service in Arizona that’s subject to the TPT.

For Employers

If you hire employees, you’ll need to register for payroll taxes, pay unemployment tax, and provide workers’ compensation insurance for your employees.

In addition to federal unemployment tax, in Arizona you’ll need to apply for an Unemployment Insurance Tax Account Number. You do this by registering with the Arizona Department of Economic Security (DES) and the Arizona Department of Revenue (ADOR). You register with both agencies simultaneously by completing an Arizona Joint Tax Application (form JT-1/UC-001) and submitting it to the License and Registration Section of ADOR. The DES will determine whether or not you’re liable for paying Arizona Unemployment Insurance taxes.

You’re also required to report the new hires to Arizona’s New Hire Reporting Center.

Can filing as an S corp lower my taxes?

The LLC business structure is meant to be flexible, and one of those flexibilities comes in how you can choose to have your LLC taxed.

By default, an LLC is taxed as a sole proprietorship if it has only one member or a partnership if it has multiple members. This appeals to most owners of LLCs because it avoids “double taxation,” in which a business pays taxes at both the business level and again when the income is paid to the individual owners. But some LLCs opt to be taxed as a C corporation or an S corporation because it works to their advantage.

Being taxed as a C corporation does mean you get double taxation, but, for certain LLCs, the pros can sometimes outweigh the cons. C corporations have the widest range of tax deductions, which could be an advantage in some scenarios. For example, insurance premiums can be written off as a business expense.

S corp is short for “Subchapter S Corporation” and is geared toward small businesses. Having your LLC taxed as an S corp has pass-through taxation like a standard LLC, but there’s another potential advantage: It could save you money on self-employment taxes.

It does this by allowing you to be an “employee-owner” and split your income into your salary and your share of the company’s profits. In this way, you pay self-employment taxes on your salary, but not your profits.

The drawback is that the Internal Revenue Service scrutinizes S corps very closely, meaning you’re more likely to get audited. S corps are also harder to qualify for.

While it’s possible that one of the above options could work better for your LLC, we don’t need to tell you that taxes are very complicated. They’re also very specific to your situation. That’s why you really need to consult a tax professional to see which taxing method works best for your Arizona business.

Open a business bank account with your EIN

Once you’ve secured an EIN, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time and helps you avoid commingling funds.

Commingling funds makes your taxes more difficult and could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities (that is, they want to sue you not just for your business assets, but also your individual assets).

Manage your AZ LLC’s finances and payments

We offer a discounted bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

For further help managing your new business’s finances, try the ZenBusiness Money App. It can help you create invoices, receive payments, transfer money, and manage clients all in one place.

Step 6: Meet the Arizona LLC publication requirement

You must meet Arizona’s publication requirement for LLCs. New LLCs must publish a notice of LLC formation in one of Arizona’s approved newspapers in three consecutive publications, starting within 60 days of receiving notice from the Arizona Corporation Commission.

The notice must include the following information:

- LLC name and address

- Name and address of your LLC’s statutory agent

- Whether your LLC is member-managed or manager-managed

- Names and addresses of managers or members, depending on the management structure

After the three consecutive publications, the newspaper will send you and the ACC an Affidavit of Publication, proving that your LLC has met the requirement. At this point, you’re all finished. Just make sure to keep the affidavit for your records.

Forming an LLC in Maricopa or Pima Counties

If you’re forming an LLC in either Maricopa or Pima counties, things are easier: You don’t need to meet the publication requirement if you live in either of those counties. Instead, the Arizona Corporation Commission posts notice of your LLC formation on the ACC’s Public Notice Database.

This is free, so you also save money on publication costs. If you choose to use our statutory/registered agent service, our Arizona office is located in Pima County, meaning you avoid the requirement and the associated fees altogether.

We can help

We offer fast, accurate Arizona LLC formation online. Our services provide long-term business support to help you start, run, and grow your business.

If starting an LLC in Arizona feels like an uphill battle, we can reduce your stress. Let us take care of formation, compliance, and more. That way, you can get back to running your dream business.

Disclaimer: The content on this page is for informational purposes only, and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

IT'S FAST AND SIMPLE

Take it from real customers

over 500,000 customers agree!

Start Your LLC in Arizona

Enter your desired name to get started

AZ LLC FAQs

-

Arizona doesn’t require a statewide general business license to do business within the state, but some local governments require one to operate in their jurisdiction.

As we mentioned earlier, most businesses in Arizona that sell goods or services will need a TPT license.

Depending on factors like your profession, industry, and location, you may require other federal, state, and/or local business licenses and permits to operate. There’s no central place to check to see every license or permit you might need, so you’ll have to do some research.

If you don’t have the time or inclination to do all this research, or if you just want the peace of mind to know that you have all the business licenses and permits you’re legally required to have, our business license report service can do the work for you.

-

The fees for starting an LLC in Arizona can range from $50 to $130, depending on factors such as whether you choose to reserve your business name or expedite your filing.

Note that fees change over time, so you should check the Arizona Corporation Commission website for the most recent fee schedule.

Of course, those costs don’t account for the value of your time as you navigate the LLC formation process. That’s where we can be a huge help — we provide practical support and expertise, holding your hand through the entire LLC formation process.

-

LLCs are a popular business structure because they combine the liability protection of a corporation with the tax savings of a sole proprietorship, along with flexibility in how they’re operated and taxed.

LLCs empower business owners to:

- Protect their personal assets from legal liability and business debts.

- Take advantage of flexible management and ownership structures tailored to the nature of their business and its owners.

- Avoid cumbersome corporate maintenance and reporting requirements.

- Pay only personal taxes on profits, rather than paying taxes on both corporate profits and individual earnings.

-

LLCs provide the benefit of avoiding “double taxation.” The business pays no federal income tax, instead passing the income straight through to the LLC’s owners.

Then, each business owner pays taxes on the earnings as regular income. This is unlike most corporations, in which profits are taxed twice, first at the business level and again at the individual shareholder level.

The IRS administers federal taxes based on each member’s share in the LLC. So, if you own 75% of an LLC and are entitled to 75% of the profits, the IRS will tax you on 75% of your LLC’s earnings.

Importantly, members might be required to pay self-employment tax to the IRS to make up for the fact that they don’t pay have an employer withholding taxes like those related to Medicare or Social Security from their paychecks.

The LLC tax structure can save business owners a significant amount of money compared to a traditional C corporation.

However, LLCs can elect to be taxed as a C corporation if they wish, subjecting owners to double taxation, though this can still be beneficial to certain LLCs.

Some LLCs elect to be taxed as an S corporation (S corp). The S corp classification has more restrictions and greater scrutiny from the IRS, but it can save members a lot in self-employment taxes. It also avoids the double taxation you would have from being taxed as a C corporation.

We have an S corp service to help you set up an LLC with S corporation status. But before you decide how to have your LLC taxed, we highly recommend consulting a tax professional.

When it comes to state income tax, Arizona upholds pass-through taxation unless the limited liability company elects to be taxed as a corporation. Nevertheless, Arizona LLCs are subject to a variety of non-income-related taxes.

Arizona business taxes may include:

- State employer taxes (if you have employees)

- State sales tax (if you sell goods)

- State unemployment tax (if you have employees)

- Taxes related to certain products (such as liquor or tobacco)

- Taxes for using certain minerals or other public resources

LLCs in Arizona are also required to pay the transaction privilege tax (TPT). While the TPT resembles a sales tax, it’s actually a tax for the privilege of running an LLC within Arizona.

If your business engages in activities subject to Arizona’s TPT, you’ll need to get a license from the Arizona Department of Revenue.

In addition to the above taxes, you might need to pay taxes based on your city — however, the Department of Revenue will collect city tax on the city’s behalf.

To better understand your state tax burden, visit the Arizona Dept. of Revenue website.

-

According to the ACC, the estimated processing time for Articles of Organization is typically 14-16 business days. You can pay an extra fee to have it processed faster, anywhere from five business days to two hours.

-

No, you don’t need to file your LLC’s OA with the state of Arizona or any other government agency. Keep it with your LLC’s important legal documents.

-

Most entrepreneurs elect pass-through taxation at the state and federal levels — owners pay state and federal taxes on the income they earn from the business, but the LLC does not pay income taxes as a business entity.

Some LLCs may choose to file taxes as C or S corporations. As mentioned previously, these options can have tax advantages for certain LLCs. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages.

We suggest working with an accountant who can explain the benefits and drawbacks of each tax classification.

-

Arizona state law doesn’t permit the Series LLC business structure, in which several separate LLCs operate under one overarching “umbrella” LLC entity.

-

If you decide to dissolve your business, you’ll need to file the Articles of Termination with the Arizona Corporation Commission. Plus, you’ll need to pay off any business debts, sell off assets, and distribute any remaining profits among the members.

Well-drafted operating agreements should describe the dissolution procedure in detail.

To learn more, see our page on Arizona business dissolution.

-

The process for transferring ownership of your Arizona LLC should be in your operating agreement. In general, two primary documents usually accompany each transfer.

Often, a purchase agreement is drafted whereby the previous owner sells its LLC interests to the buyer. Next, the agreement is amended to reflect the change in ownership (along with any other changes desired by the new collective membership).

The state will also need to be updated on the ownership changes with an amendment to the Articles of Organization.

-

A DBA — or a “doing business as” name — is a business name LLCs can use instead of their legal name. The Arizona Corporation Commission doesn’t handle DBAs.

Instead, check with the Arizona Secretary of State to confirm the name isn’t already taken. Then, you can submit an online Trade Name Application to get your DBA.

-

Your operating agreement should detail your LLC’s procedures for removing members from the business, including any voting or cause-related requirements.

Additionally, you’ll need to follow your agreement’s procedures outlining how the removed member’s share will be distributed among the remaining members or offered for sale to third parties.

Finally, you’re required to file Arizona Articles of Amendment to update your LLC’s Articles of Organization with the state. You’ll also want your LLC operating agreement to reflect the new changes.

-

Unlike many other states, Arizona doesn’t require LLCs to file annual reports with the Arizona Corporation Commission. This saves owners of Arizona LLCs the headache of needing to remember when to file and pay yearly state filing fees.

-

You don’t need a business plan to register with the Arizona Corporation Commission or legally form your LLC. But having a business plan helps you in multiple ways.

A business plan outlines your new LLC’s structure, goals, and plans. A good plan also contains information on the business’s founders, market research, and potential financing sources.

Drafting a plan might also make it easier for you to find investors or lenders who want to help you jump-start your business.

-

In Arizona, new LLCs are required to publish a public notice of the filing of Articles of Organization unless their business address is within Maricopa or Pima counties. The notice must be published at least three times in a newspaper that’s approved by the ACC. This notice must be published within 60 days after receiving a Notice of Publication from the ACC.

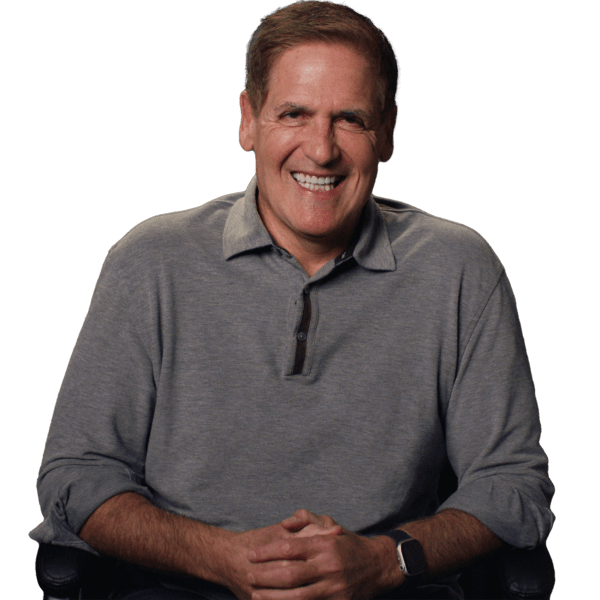

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

- Form an LLC to protect your liability

- Set up your banking and accounting

- Grow sales by marketing your website

Arizona Business Resources

Start an LLC in Your State

When it comes to compliance, costs, and other factors, these are popular states for forming an LLC.

Ready to Start Your LLC?